The 2019 Arrest of Uwe Lenhoff

In January 2019, German citizen Uwe Lenhoff was taken into custody following an extensive investigation by authorities in Germany, Austria, and other EU member states. Prosecutors allege that Lenhoff operated a broad network of fraudulent binary options websites, defrauding tens of thousands of retail investors across Europe with estimated losses surpassing €100 million.

Simultaneously, a European arrest warrant was issued for his associate, Gal Barak of Israel, signaling the coordinated efforts by law enforcement to dismantle the operation.

The Lenhoff Network: A Closer Look

Currently detained in Germany, Uwe Lenhoff, 55, awaits trial. Additional individuals, such as former boiler room operators Betim Tasholli and Mohamad Shaker, are also under investigation. Meanwhile, Bulgarian authorities have approved the extradition of Gal Barak to Austria.

Payvision and Its Link to Lenhoff

A significant partner in Lenhoff’s operation appears to have been Rudolf Booker, founder of the Dutch-based Payvision, a payment service provider. In March 2018, ING Bank completed the acquisition of a 75% stake in Payvision, valuing the company at €360 million — a deal that elevated Booker’s profile as one of the leading tech entrepreneurs in the Netherlands.

However, this valuation is believed by some to have been inflated due to Payvision’s transactional volume with clients like Lenhoff and other binary options schemes.

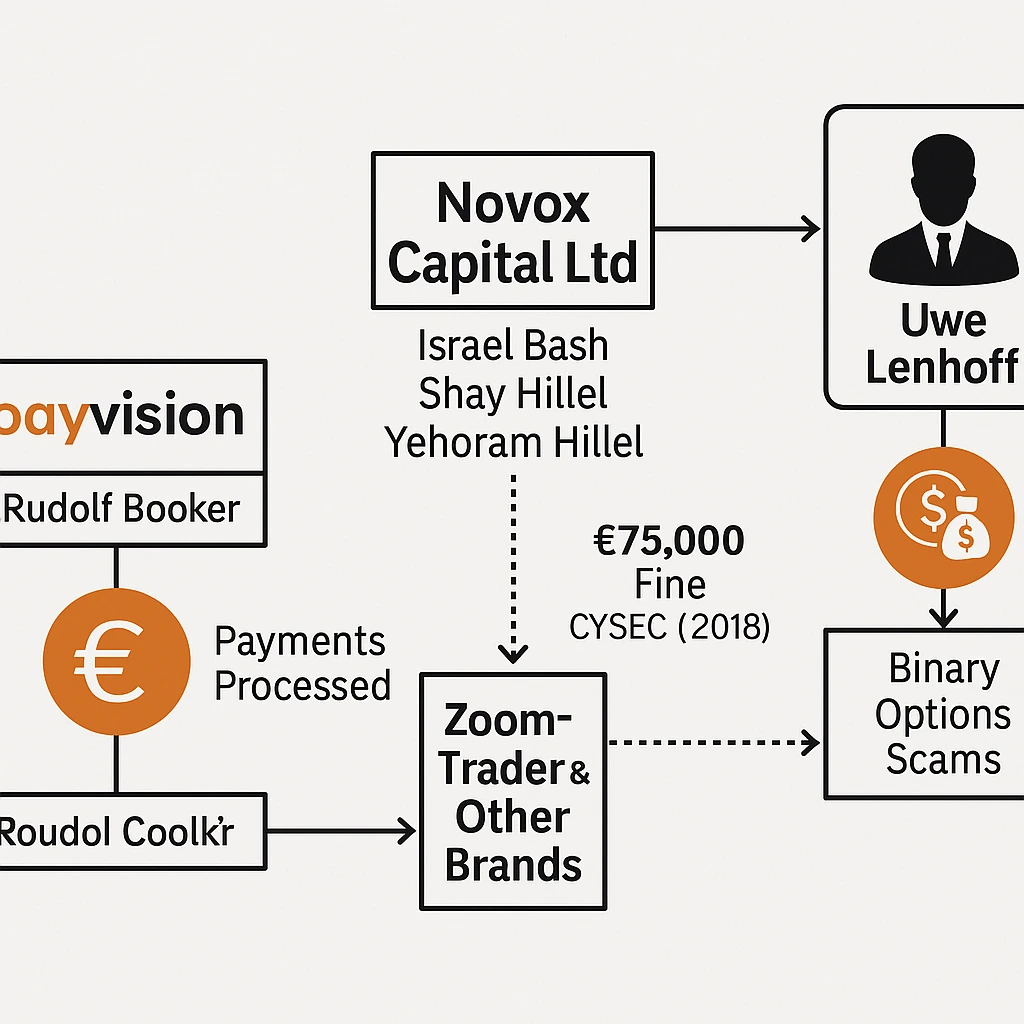

Lenhoff, for his part, claimed to have worked as an affiliate on behalf of Booker and Payvision, stating that he introduced Gal Barak, as well as entities like Novox Capital Ltd, to Payvision’s services.

June 2016: Planning Session at Payvision HQ

In June 2016, according to reporting by Scam-Or Project, its publisher attended a day-long meeting in Amsterdam involving Payvision’s management, Lenhoff, and other representatives of binary options platforms. Discussions reportedly centered on increasing Payvision’s revenue through cooperation with binary options operators.

At that time, binary options had not yet been prohibited, and few regulatory warnings had been issued. Warnings from European regulators and North American institutions, such as Visa’s suspension of binary options in Canada, began to emerge only in late 2016.

Transaction Volume and Timing

Between 2015 and 2018, Payvision is said to have processed hundreds of millions of euros in transactions for various binary options platforms — a considerable share of which was tied to Lenhoff’s network.

According to financial records reviewed by investigators, Payvision continued to process payments for Gal Barak’s broker brands — including XTraderFX, SafeMarkets, and Golden Markets — through the end of 2018. Millions of euros reportedly flowed from Payvision to accounts held by Barak’s companies at Investbank in Bulgaria, despite increasing international regulatory warnings beginning in early 2017.

Intercepted Calls: Lenhoff and Booker as “Trusted Allies”

Wiretap evidence from December 2018 to January 2019 reveals recorded conversations between Rudolf Booker and Uwe Lenhoff, in which they spoke candidly about growing concerns over Scam-Or Project’s publications and regulatory attention.

In these calls, Booker reportedly referred to Lenhoff as his “buddy.” The conversations also included references to Novox Capital Ltd, its issues with CySEC, and problematic platforms like ZoomTrader and ZoomTraderGlobal. Lenhoff appeared to reassure Booker amid growing tension.

Novox Capital: Licensing Issues and Penalties

Novox Capital Ltd, a Cypriot-licensed investment firm, was controlled by Israel Bash, Shay Hillel, and Yehoram Hillel — all Israeli nationals. The company operated multiple binary options brands that were later identified as fraudulent. Though Novox held a license from the Cyprus Securities and Exchange Commission (CySEC), it was repeatedly penalized for violations.

In early 2018, CySEC imposed a €175,000 fine on Novox Capital for license breaches — one of several regulatory actions taken against the company.

An Interconnected Web of Operators

Available evidence points to strong operational and financial links between:

-

Uwe Lenhoff and his Veltyco operations

-

Gal Barak and E&G Bulgaria

-

Novox Capital Ltd and its Israeli owners

-

Rudolf Booker and Payvision

In light of these connections, it appears that Booker and Lenhoff were aware of the compliance risks and reputational damage associated with these clients. Nonetheless, the collaboration persisted.

Their intercepted discussions in late 2018 suggest an awareness of looming legal and media threats — an acknowledgment that may become crucial in any future legal assessments of Payvision’s role.