Introduction

Sergei Kosenko—known to his vast Instagram audience of 49 million as @mr.thank.you—is under intense international scrutiny. A recent criminal complaint filed by a Dubai-based investor, supported by testimonies from additional victims, accuses Kosenko of copying STEPN’s Web3 fitness concept through his AMAZY token and orchestrating a scheme that drained millions by dumping 99% of the supply. Russian authorities have already seized ₽206 million (~US $2.1 million) in his local bank accounts and placed him on their national “Most Wanted” registry. Global regulators are now being urged to intervene to prevent further retail losses.Russian Court Actions

A Moscow court has implemented interim measures freezing Kosenko’s accounts in Russian banks. The blogger, notorious for posting footage of throwing his two-month-old son into a snowdrift, now has over ₽206 million immobilised, according to TASS. TASS report, October 2024 (report)Key Points

- Victim filings: A seven-page criminal complaint submitted to Dubai Police and reviewed by Scam-or Project details crypto fraud, counterfeit cash distribution, and child-endangerment allegations against Kosenko.

- Asset freeze in Russia: Courts froze 43 bank accounts holding ₽206 million after TASS traced them to suspected illicit crypto gains (Source: TASS).

- Most-Wanted notice: Russia’s Interior Ministry issued a national arrest warrant for Kosenko on 13 Oct 2024 (Source: РБК).

- AMAZY token collapse: $AZY peaked at $0.4468 on 4 Aug 2022 and has since fallen by -99.93%, wiping out nearly all investor value (Source: CoinMarketCap).

- STEPN-copy model: CoinsPaid Media confirms AMAZY mimicked STEPN’s “NFT sneaker” structure without external VC investment (Source: CoinsPaid Media).

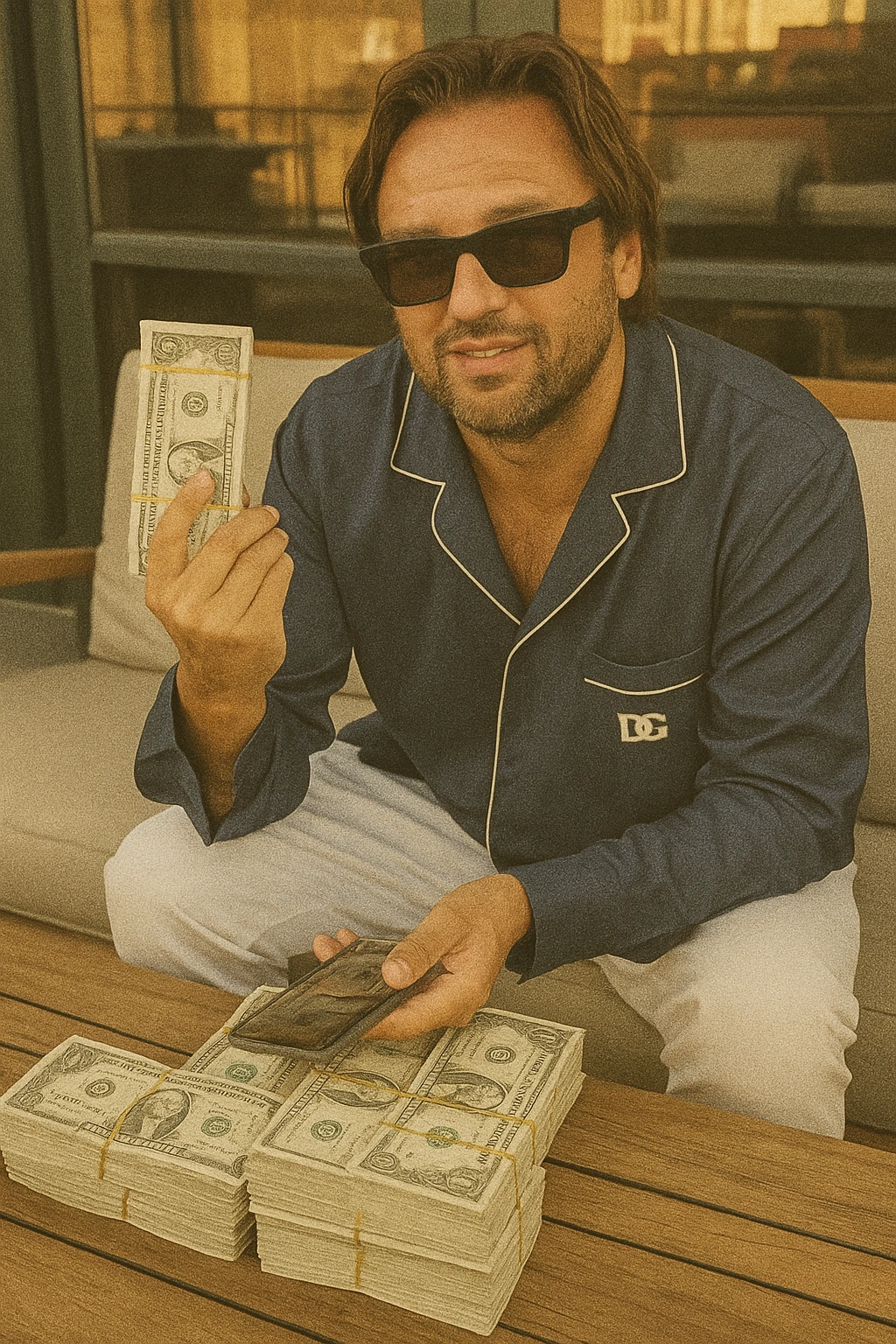

- Weaponising social reach: Kosenko used his almost 50 million Instagram followers to boost giveaway videos and counterfeit-cash stunts that fuelled token hype (Source: РБК).

Short Narrative

Based in Dubai, influencer Sergey Kosenko launched AMAZY in mid-2022, presenting it as a revolutionary “move-to-earn” app inspired by STEPN. Early investors purchased expensive NFT sneakers to earn $AZY rewards.

On-chain data quickly revealed daily trading volumes in the millions, as later confirmed by whistleblower victims. But soon after, liquidity vanished. Blockchain records showed that approximately 99% of the circulating supply was dumped into exchange pools, collapsing the price. Investors were left with worthless tokens, while Kosenko relocated to Dubai, flaunting giveaway videos filmed with fake banknotes.

Simultaneously, Russian investigations resulted in asset freezes, and by October 2024, the Interior Ministry had listed him as wanted for child abuse and financial offences.

Based in Dubai, influencer Sergey Kosenko launched AMAZY in mid-2022, presenting it as a revolutionary “move-to-earn” app inspired by STEPN. Early investors purchased expensive NFT sneakers to earn $AZY rewards.

On-chain data quickly revealed daily trading volumes in the millions, as later confirmed by whistleblower victims. But soon after, liquidity vanished. Blockchain records showed that approximately 99% of the circulating supply was dumped into exchange pools, collapsing the price. Investors were left with worthless tokens, while Kosenko relocated to Dubai, flaunting giveaway videos filmed with fake banknotes.

Simultaneously, Russian investigations resulted in asset freezes, and by October 2024, the Interior Ministry had listed him as wanted for child abuse and financial offences.

Extended Analysis

| Dimension | Findings | Implications |

| Legal | Russian indictments include fraud (crypto Ponzi) and child endangerment. UAE and U.S. investors have lodged complaints, making cross-border MLAT requests feasible. | Rising extradition risk; assets outside Russia may be seized under civil forfeiture frameworks. |

| Regulatory | AMAZY bypassed securities laws, lacked white-paper disclosures or VC due diligence, and relied on influencer promotions. | SEC-style enforcement possible if U.S. solicitation is proven; ESMA and Dubai VARA may claim jurisdiction. |

| Operational | Pump-and-dump executed via insider wallets dumping into low-liquidity pools. CoinMarketCap showed a 433% volume/market-cap ratio—classic warning sign (Source: CoinMarketCap). | Exchanges listing $AZY could face pressure to delist; compliance should review KYT alerts for wash trades and insider activity. |

| Reputational | YouTube exposés (“Почему AMAZY криптовалютная пирамида”) continue to garner hundreds of thousands of views (Source: YouTube). | Influencer-marketing platforms risk association damage; brands collaborating with Kosenko may face ESG-related backlash. |

2 Comments

The Russian authorities have now issued an arrest warrant and ordered that the influencer be extradited to Russia to face charges. They also ordered that he be detained for two months from the moment he arrives on Russian soil. He is a scammer with many accounts that way he can hide his scamming by just blaming it on “imposters” but the bottom line that MR.THANKYOU is a scammer. He scammed me for $750.00 by making promises like a new car, $30,000.00 and a new IPhone. It was just a lie and a scam.

Thank you so much for the insight. We are in the process of filing a complaint against Kosenko to the FBI. If you are a U.S. citizen, please email us at [email protected]. We would love the opportunity to obtain your statement that we can reference in our report to the FBI.