Background: $165 Million Binary Options Fraud

The Canadian-Israeli Cartu Brothers—David, Joshua, and Jonathan Cartu—have been identified as key figures behind a $165 million binary options scheme, according to a fraud complaint filed by the U.S. Commodity Futures Trading Commission (CFTC). In addition to the Cartu siblings, Nati Peretz and Leeav Peretz were also named in the 2020 U.S. legal action.

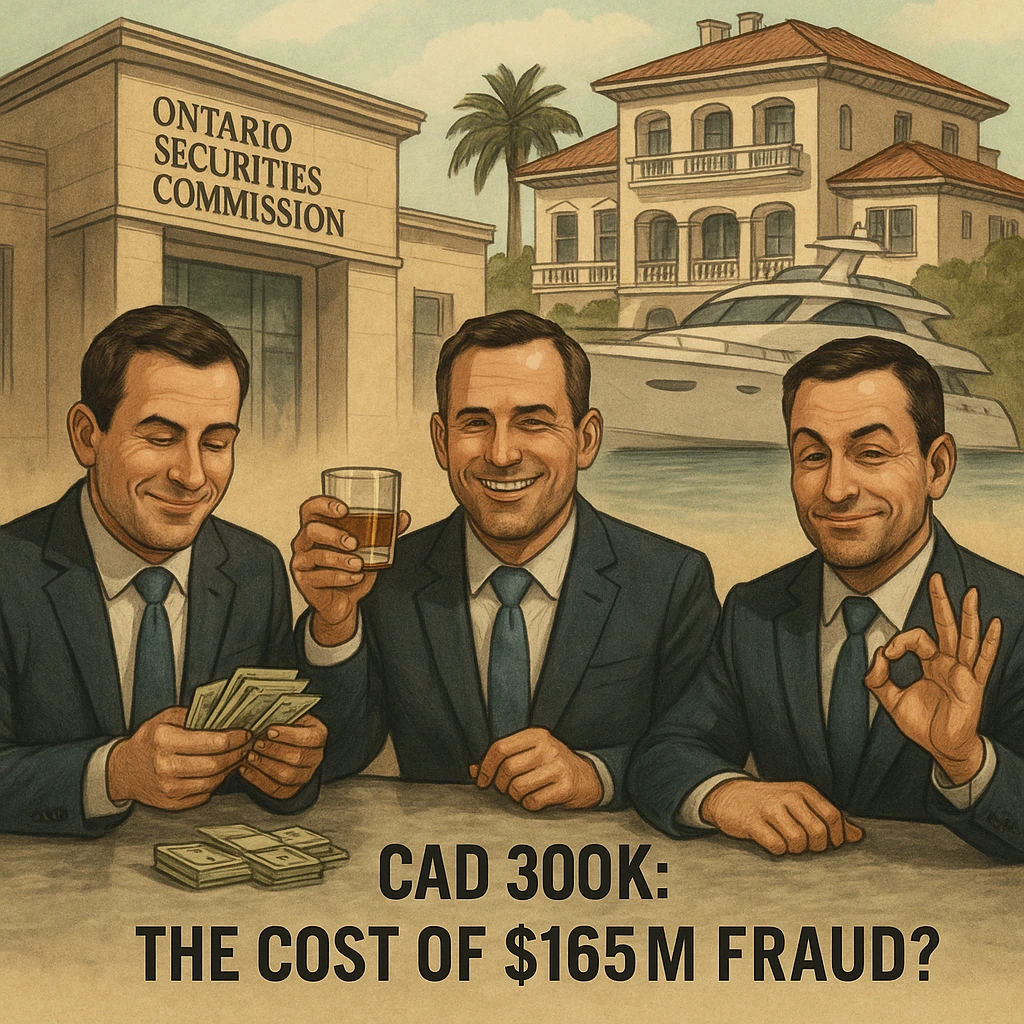

Simultaneously, the Ontario Securities Commission (OSC) pursued its own enforcement against the Cartu Brothers over similar fraudulent activities targeting Canadian investors. However, the latest development has raised eyebrows across the regulatory and financial fraud watchdog community.

Settlement Terms: CAD 300,000 to Close Fraud Case

The Cartu Brothers, despite being accused of large-scale financial fraud, are now reportedly settling the OSC’s case for just CAD 300,000. A minor penalty when viewed in light of the scale of the alleged misconduct. Observers argue that such a lenient outcome may be viewed by the brothers—and others in the industry—as little more than a laughable cost of doing business.

GMM and the Wirecard Connection

At the heart of the Cartu fraud network was GreyMountain Management Ltd (GMM), a payment processor registered in Ireland. GMM handled payments for a wide network of binary options scams and reportedly had associations with the now-defunct Wirecard. While GMM was never regulated as a payment institution, it served as a financial hub for a variety of fraudulent brands.

According to both OSC and CFTC filings, GMM facilitated transactions for numerous scam entities, including:

-

BeeOptions

-

Glenridge Capital

-

Rumelia Capital

Estimates suggest that more than $500 million in customer deposits were processed through GMM on behalf of these and other fraudulent platforms.

OSC Allegation and Payout Breakdown

The OSC’s official Statement of Allegations claimed that approximately 700 investors from Ontario alone lost a combined CAD 1.4 million through GMM-linked operations. When contrasted with the CAD 300,000 settlement, the numbers tell a disturbing story about the value placed on regulatory enforcement.

|

Alleged Losses |

Settlement Amount |

|

CAD 1.4 million (700 victims) |

CAD 300,000 (collective penalty) |

The disparity between the damage done and the fine imposed raises serious concerns about the message such a settlement sends.

Implications: A Dangerous Precedent

Many experts and financial fraud watchdogs, including Scam-Or Project, criticize the OSC’s decision, suggesting it undermines public trust and signals leniency toward white-collar crime. The perception now is that, for those caught operating massive scams, the consequences are minimal—pay a nominal fee, and enjoy the proceeds.

This outcome may embolden future bad actors and discourage victims from coming forward. As one industry analyst put it, “This wasn’t justice—it was a bargain.”

Take Action: Exposing Scams and Enablers

The fight against online investment fraud continues. If you have information about binary options scams or illicit payment processors, report them to trusted investigative resources such as Scam-Or Project.