The FinTech Sector’s Role in Supporting Fraud

The importance of financial technology providers in enabling large-scale investment fraud has become increasingly evident. U.S. prosecutors have repeatedly emphasized that online scams often rely on cooperating FinTech firms to handle transactions. Without these intermediaries, it would be significantly more difficult — if not impossible — for scam operations to collect funds from retail victims.

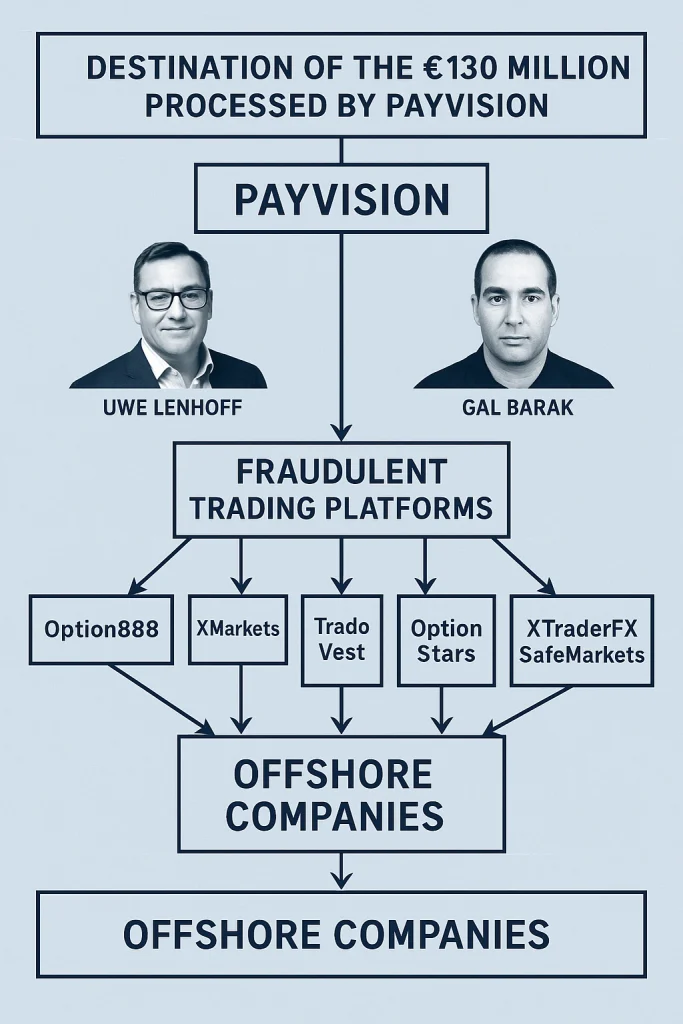

One of the most telling examples of this is the case of Payvision, a Dutch FinTech company and former ING subsidiary, which is reported to have processed around €130 million in payments for schemes tied to Uwe Lenhoff and Gal Barak, both of whom are currently in prison awaiting further criminal proceedings.

Recent investigations have validated concerns about the role of FinTechs in facilitating cybercrime — moving this topic from speculation into a well-documented reality.

Payvision and Its Connection to Fraudulent Platforms

Payvision (www.payvision.com) served as a major payment processor for a wide range of fraudulent broker platforms operated by Lenhoff and Barak, including:

-

Option888

-

XMarkets

-

TradoVest

-

OptionStars

-

XTraderFX

-

SafeMarkets

-

GoldenMarkets

However, these platforms represented only a portion of the many high-risk clients that used Payvision’s services. Based on transaction records, it is likely that the true volume of illicit payments processed between 2016 and 2019 could exceed €1 billion.

Documentation reveals that Payvision handled €130 million in payments for Lenhoff and Barak over a span of nearly three years. This was allegedly done without proper Know-Your-Customer (KYC) protocols, and thousands of suspicious transactions were processed with insufficient Anti-Money Laundering (AML) oversight.

Even more concerning, substantial transfers continued just days before Lenhoff and Barak were arrested, with millions reportedly sent to their offshore accounts.

Regulatory Inaction and Contradictory Conduct

Despite rising red flags and 273 suspicious activity reports (SARs) filed between mid-2018 and 2019, Payvision continued to process payments for Lenhoff and Barak. In some instances, it merely adjusted its fee structure, allowing business to continue with minimal disruption.

This behavior has raised serious questions:

-

Why were payments still being processed despite internal SARs?

-

Why did regulatory authorities fail to intervene sooner?

-

Why wasn’t the business relationship terminated earlier?

The apparent disconnect between compliance reporting and actual action suggests either negligence or deliberate facilitation.

Awareness and Accountability: The Role of Rudolph Booker

According to multiple investigative findings, Rudolph Booker, founder and former CEO of Payvision, was well aware of the nature of Lenhoff and Barak’s operations. Documents and wiretap transcripts reportedly show that Booker had knowledge of the illicit nature of the business, yet chose not to cut ties.

Despite this, Booker has not yet been named as a suspect in any ongoing criminal proceedings — a fact that continues to prompt criticism from observers familiar with the case.

Scam-Or Project’s Role as a Catalyst

Independent media outlet Scam-Or Project published a series of reports on September 24, 2018, which appear to have been the catalyst for Payvision’s internal reevaluation of its relationships with Lenhoff and Barak.

In law enforcement statements, Booker acknowledged that these public reports triggered concern. Yet despite the SARs filed afterward, Payvision did not terminate the partnerships entirely, and millions of euros continued to be transferred until shortly before the arrests in early 2019.

Calls for Legal Consequences

Given the documented transaction history, suspicious activity filings, and internal awareness, many believe that Payvision, ING, and Rudolph Booker should be held accountable for their role in enabling fraudulent operations.

Only through legal action and restitution processes can the thousands of affected retail investors expect to recover their losses.

The case of Payvision remains a powerful example of how FinTechs, when unchecked, can become active facilitators of financial crime — and why stronger oversight, transparency, and corporate accountability are urgently needed in the sector.