Oleg Torbosov: Real Estate Magnate or Master Deceiver?

Oleg Torbosov, the founder of the real estate agency Whitewill, markets himself as a global tycoon selling properties in Moscow, Dubai, Abu Dhabi, London, Miami, and Oman. Each month, on the first day, he posts updates on Facebook claiming astronomical real estate sales surpassing $100 million monthly, boasting over $1 billion in annual sales. However, a closer look into the legal and financial underpinnings of his operations reveals a disturbing disconnect between rhetoric and reality.

Social Media Bragging vs Ground Reality

Between May and August 2025, Torbosov’s Facebook posts were filled with confident declarations of hundreds of millions in real estate sales. These public posts, pasted below, showcase an ongoing effort to craft an image of unprecedented success:

August 1, 2025 Facebook Post:

We wrapped up July. Closed 131 deals worth 10.4 billion rubles. Rental brought another 55 deals for ₽21 million. With such sales volumes, I feel two conflicting emotions.

On one hand, the market isn’t the easiest right now: extreme heat and low season in the Emirates, high interest rates and economic freeze in Moscow. Yet we still manage to sell 10 billion rubles’ worth of real estate every month.

On the other hand, our company’s unit economics is built on an average monthly sales volume of 13 billion. That’s when everyone is enjoying the process, feels good, and I earn well. We’ve lived with those monthly figures for the past two years, and I don’t want to lose that.

In June, Moscow contributed 70% of deal volume. Among the top deals: an apartment in Luce — ₽570 million, an office in “City Park” — ₽700 million, and a penthouse on the secondary market in “Sadovye Kvartaly” — ₽490 million. Outside the city: ₽195 million for a house in Mertemyanovo.

Our Arab offices consistently bring in 30% of revenue. And that’s worth a lot because there are no taxes in the Emirates. The largest deal in Dubai was Lumena by Omniyat — $8.3 million; in Abu Dhabi, a villa from Jacob & Co — $2.3 million. In Oman, we closed 12 deals totaling $3.7 million. The biggest was a villa in Aida Oceana for $600K.

Interestingly, all clients in Oman were foreigners. Not a single Russian speaker. Mostly Europeans and Arabs.

I compared the first half of 2024 with the same period in 2025. We’re trailing by 9% — ₽77 billion last year vs. ₽71 billion this year.

It remains to be seen whether we’ll catch up or if this will be the first year in our company’s history when we sell less than the year before.

All resources are currently being reinvested in the business — I’m not withdrawing dividends and am heavily investing in marketing. I have a plan and I’m sticking to it. I’m holding many meetings in the office across departments. Implementing various optimizations. It’s an interesting time.

If you’re planning to buy property in Moscow or the Emirates — reach out to Whitewill. We’re doing our best. We’re working. We won’t let you down.

July 1, 2025 Facebook Post:

Whitewill’s June deals. Could’ve been worse.

June wasn’t record-breaking. The team closed 134 deals totaling 9.05 billion rubles. Weaker than May — but it could’ve been worse.

Moscow traditionally led with 72 deals totaling ₽6 billion, making up 65% of total volume. International offices contributed 35%.

The rental department closed 48 deals totaling ₽22 million. The retail and secondary market departments performed well. Mansions, offices, and suburban properties brought in great stories.

Largest deal in Moscow — an apartment in Victory Park Residences for ₽570 million. Second largest — a unit in “Russian Seasons” for ₽460 million.

Top international deals: Dubai — Al Waha Residences for $5.8 million; Abu Dhabi — The Beach House Fahid for $1.2 million; London — Landmark Pinnacle apartment for $1.5 million.

The market downturn in Moscow due to high interest rates and instability in the Middle East (Iran-Israel conflict) led to delays and cancellations of about ten deals. No blame. Total understanding.

Nine billion is a solid result under these circumstances. Could’ve been worse. We keep working.

June 1, 2025 Facebook Post:

One. Two. Three. Summer. Whitewill May deals report.

The last days of spring fell on the end of the week. On Friday, May 30, I had a coordination meeting with the team:

— A few large deals were postponed to June, one of the managers reported.

— Registration was suspended on a ₽700 million deal, another added. We’re working on it.

— Tough negotiations on large spaces. The sale was pushed to summer.

— Clients for the expensive house couldn’t fly in for signing. They promised June.

I listened to the updates. Looked over the reports. Poured some chamomile tea. Took a deep sip.

A month full of “let’s do it after the May holidays” didn’t turn out as strong as I’m used to. The team closed 120 deals totaling ₽9.6 billion. 70% — Moscow. 30% — international offices.

For us, a healthy norm is 150–200 deals and ₽13–15 billion in sales. So I’m not happy with May. Though I understand that for many of our competitors, selling ₽7 billion worth of property in Moscow under today’s conditions is their annual goal — not monthly.

I was pleased with the rental department’s numbers. The team closed 58 deals with total monthly contract value of ₽44 million. That’s our record in rental volume. And since the commission equals one month’s rent — the results are solid.

Top deal in Moscow — a penthouse in “Sky View” for ₽1.1 billion. In Dubai — a unit in DIFC Heights for $1.8 million. In Abu Dhabi — an apartment in The Source 2 for $2.2 million. In London — Marylebone Mansions for $2.2 million.

In Miami we closed three rental deals. Meanwhile, our Miami office lease expired. Will we renew it? I decided not to. The team was even happy — no more team meetings to commute to. We’ll see how remote work goes. If they do well, we might bring the office back.

We said goodbye to May. Goodbye to spring. Since April was strong for us, we’ll let the May holiday slowdown slide.

Thanks to all our partners for sending us clients. Thanks to all our clients for choosing my company for their transactions. Thanks to the team. I’m counting on a vibrant summer. Let’s keep crushing it.

May 1, 2025 Facebook Post:

Whitewill’s April deals. Solid sales. Trip unlocked.

April has long competed with December for the highest sales volume. A strong month. Last year we crossed the ₽20 billion mark in April — and that became our benchmark for this year. The team strived. I checked the numbers weekly, fingers crossed.

In the end, the team closed 141 deals totaling ₽17.3 billion. Just shy of the goal. The rental department closed another 51 deals totaling ₽29 million.

As usual, 69% of sales came from Moscow. The Middle East gave us 27%. London and Miami — 4%.

Deal of the month — a mansion near the Kremlin for ₽4.5 billion. The largest ever in the Moscow office’s history.

Among new builds, the biggest deal was a unit in “Luzhniki Collection” for ₽360 million. In Dubai, the top sale was an apartment in Oasis Palace by Emaar for $5.1 million (₽420 million). In Abu Dhabi — an apartment in Mandarin Oriental for $4.5 million (₽370 million). In London — The Chimes apartment for £2.6 million (₽280 million).

Since our last trip, I gave the team a goal of ₽17 billion. On the last day of the month, we were short by almost ₽2 billion. “Well, I guess the trip will be unlocked another month,” I thought, closed my laptop, and went to the gym. But by the evening, the team brought in so many last-minute deals that we hit the goal.

Apparently, clients, brokers, and developers all rushed to sign their deals before the May holidays to vacation with peace of mind.

And we’ll fly off for vacation soon too. Wishing the same to you. Happy Spring and Labor Day, my friends.

The 10,000-Ruble Problem

While Torbosov’s Facebook page flaunts extravagant claims, all of his companies registered in Russia report an authorized capital of just 10,000 rubles (~$125), the legal required minimum. Such a modest structure is alarmingly incongruent with the supposed size of his empire. In most functioning markets, especially in Russia, such a discrepancy would trigger investigations by the Federal Tax Service and law enforcement agencies. Yet, Torbosov remains untouched, freely traveling internationally and continuing to market his brand aggressively.

Is Torbosov the Real Owner?

Industry insiders in both Russia and Dubai speculate that Torbosov is not the true financial power behind Whitewill. It is rumored that an anonymous investor has financed his expansions, including luxury offices and marketing campaigns. This suspicion grows stronger in light of the fact that multiple Whitewill branches are set up in different countries with similarly low starting capital.

An Interview Built on Lies?

In an interview published on YouTube, Torbosov doubles down on his claims, offering vague figures and unverifiable success stories.

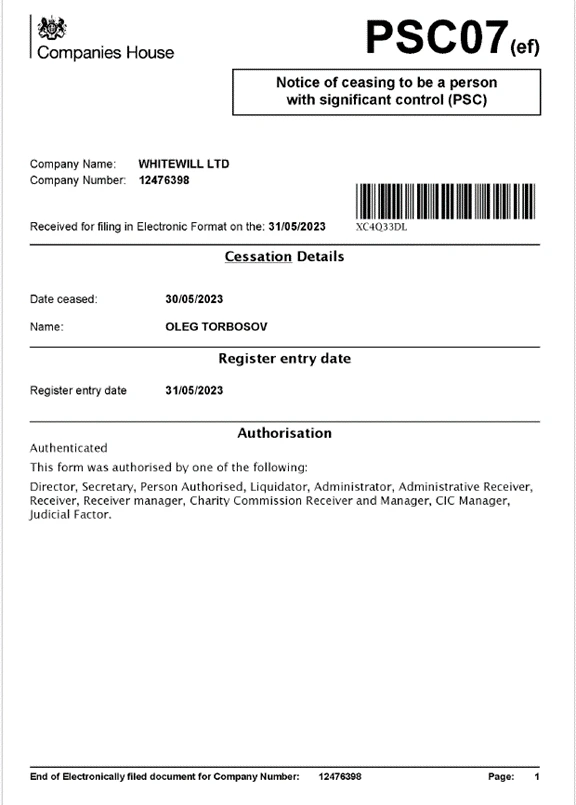

Shell Companies in the UK

Documents from the UK Companies House confirm that Torbosov has opened and quickly liquidated several businesses with minimal capital, following a similar pattern. These shell entities raise serious red flags about the long-term credibility and transparency of his operations abroad.

Connections to Crypto Scammers

A particularly troubling association is Torbosov’s friendship with Sergei Kosenko (as reported on FinTelegram), a known promoter of the controversial cryptocurrency project AMAZY. Kosenko, widely criticized in media reports including Scam-Or Project and FinTelegram, has been implicated in orchestrating what appears to be a large-scale cryptocurrency Ponzi scheme. Numerous videos on YouTube clearly show the two men engaging in interviews and mutual promotions. While these appearances may seem benign on the surface, they point to a deeper alignment between Torbosov and figures central to dubious crypto ventures. This friendship raises serious concerns about the integrity of Torbosov’s business network and adds another red flag to his already questionable real estate empire.

Conclusion: A Public Warning

Oleg Torbosov continues to enjoy public attention and a carefully curated media persona. However, the foundations of his real estate empire appear fragile and possibly fraudulent. From undercapitalized legal entities to rumors of shadow investors, and wildly inflated public claims—there is much the public must question. Authorities in Russia, the UK, and the UAE should take a closer look. The public deserves transparency, not deception dressed as glamour.

If you have any additional investigative data on either Oleg Torbosov or Sergei Kosenko, please reach out to Scam-Or Project. We guarantee full anonymity.