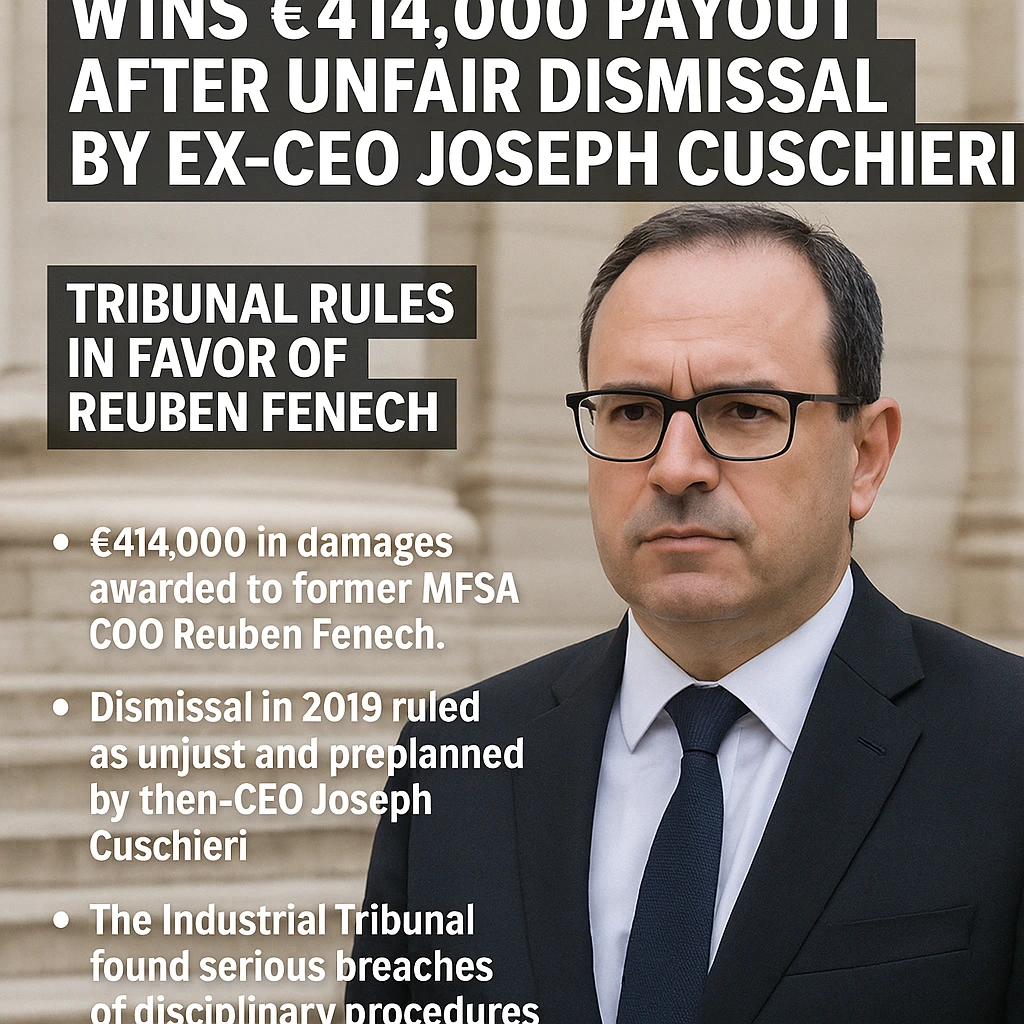

Tribunal Rules in Favor of Reuben Fenech

The Malta Financial Services Authority (MFSA) has been ordered to pay nearly €414,000 in compensation to its former Chief Operating Officer, Reuben Fenech, after his 2019 dismissal was found to be both unjust and premeditated. The decision comes as another blow to the regulator’s credibility under the leadership of Joseph Cuschieri, whose tenure has been marred by controversy and reputational decline.

Key Points

-

€414,000 in damages awarded to former MFSA COO Reuben Fenech.

-

Dismissal in 2019 ruled as unjust and preplanned by then-CEO Joseph Cuschieri.

-

The Industrial Tribunal found serious breaches of disciplinary procedures.

Case Summary

In its ruling, the Industrial Tribunal in Malta determined that Reuben Fenech was unfairly terminated despite positive performance evaluations just months prior. According to the Tribunal, former CEO Joseph Cuschieri acted in breach of established MFSA procedures, failing to follow proper disciplinary processes and effectively damaging Fenech’s career.

The Tribunal emphasized that the dismissal was not only procedurally flawed but also deliberately orchestrated, making it a serious violation of employment rights.

The Cuschieri Legacy

Appointed as MFSA CEO in 2018 and personally selected by then-Prime Minister Joseph Muscat, Joseph Cuschieri resigned in 2020 after the emergence of his close ties to Yorgen Fenech—a businessman accused of involvement in the assassination of journalist Daphne Caruana Galizia.

An internal ethics investigation later confirmed that Cuschieri breached both MFSA and European Central Bank guidelines when he accepted a luxury trip to Las Vegas in 2020 with Fenech. The trip included five-star accommodation at Caesars Palace, with flights and expenses paid by Fenech. MFSA’s General Counsel Edwina Licari also accompanied them.

Compliance Implications

The case underlines how critical it is for regulatory authorities to uphold transparent, impartial, and rule-based disciplinary practices—especially for senior officials. Arbitrary dismissals not only harm the careers of the individuals involved but also undermine institutional trust.

Malta’s greylisting experience served as a stark reminder of the reputational and economic risks of governance failures in the financial regulatory sector. This ruling further highlights governance issues within the MFSA, particularly its disregard for its own Staff Handbook.

Call for Whistleblowers

If you have credible information about misconduct within financial regulators—or believe you have been treated unfairly by such bodies—Scam-Or Project invites you to share it securely via our dedicated whistleblower platform.