In the first part of our investigation, Scam-Or Project uncovered Wirecard’s close relationship with SpotOption, a key Israeli provider of white-label platforms for binary options. In this second installment, we turn our attention to GreyMountain Management Ltd (GMM), an Irish entity central to the proliferation of fraudulent binary options operations.

The Binary Options Boom — And Collapse

Between 2012 and 2018, binary options were at the heart of what is now considered one of the largest internet-driven fraud ecosystems in history. The FBI estimates that global retail investors lost as much as $10 billion annually due to these scams. Thousands of unlicensed brokers exploited unsuspecting victims, and payment providers like Wirecard played varying roles—some as passive processors, others as active collaborators. Wirecard belonged to the latter.

GreyMountain Management’s Role in the Fraud Machine

GreyMountain Management, headquartered in Ireland, emerged as one of the principal enablers in the early binary options landscape:

-

Active between 2014 and 2016, GMM facilitated fraudulent schemes targeting retail investors.

-

Regulatory bodies across jurisdictions repeatedly warned against GMM.

-

Evidence suggests GMM worked closely with Wirecard to process payments for multiple binary options websites.

-

Notably, Wirecard UK & Ireland and GMM shared the same headquarters address in Dublin.

-

Wirecard was previously involved with Banc de Binary, a scheme penalized by the CFTC and SEC.

-

Directors from Wirecard and GMM jointly founded payment ventures, deepening the operational overlap.

Shared Address: A Dublin Headquarters for Fraud

Both Wirecard UK & Ireland Ltd and GreyMountain Management Ltd operated out of Ulysses House, 1 Foley Street, Dublin—Wirecard on the 1st floor, GMM on the 3rd. GMM was incorporated in 2014 and dissolved following multiple regulatory alerts and investigations by Irish authorities.

During its peak, Wirecard directors Alan White, Michelle Molloy, and Jan Marsalek oversaw operations from this location.

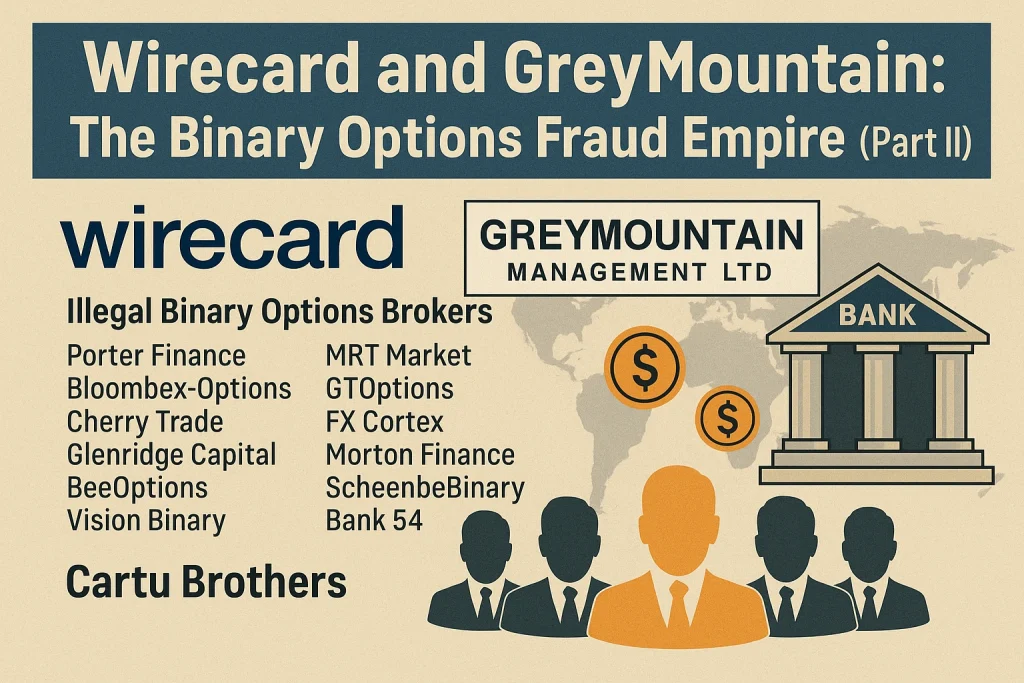

GreyMountain’s White Label Web of Scams

GMM didn’t just host fraudulent brokers—it created them. Through white-label partnerships, GMM offered trading platforms and payment services in exchange for hefty commissions. Like SpotOption, PandaTS, and Tradologic, GMM became a hub for illegitimate operators. Notable associated brands include:

|

Broker Name |

Broker Name |

|

Porter Finance |

MRT Market |

|

Bloombex-Options |

GTOptions |

|

Cherry Trade |

FX Cortex |

|

Glenridge Capital |

Morton Finance |

|

BeeOptions |

ScheenberBinary |

|

Vision Binary |

Profit System |

|

UKOptions |

Iq Option |

|

Starling Capital |

Professional Binary Robot |

|

EdgedaleFinance.com |

Bank 54 |

Regulators worldwide, including those in the U.S., Europe, Eastern Europe, and Asia, issued cease-and-desist orders against many of these entities.

Montenegro’s Dirty Money: The Atlas Bank Link

The Wirecard-GMM saga expanded into Montenegro with the establishment of Montival DOO Podgorica in 2013. Created to manage cash flow, Montival became a client of Atlas Bank, which has since been implicated in laundering nearly €500 million. Victims of sites like Bloombex Options and Bank54 funneled their deposits through this channel—only to lose them permanently.

Legal Action Against GreyMountain

GMM’s management featured key Israeli figures including David and Jonathan Cartu and Uri Katz. Katz also held ties to Banc de Binary, a major binary options platform shuttered after regulatory crackdowns.

In 2018, a group of investors from the U.S., Canada, Singapore, UAE, and the UK filed a lawsuit in Ireland’s High Court. They accused GMM directors Liam Grainger, Ryan Coates, and the Cartu brothers of defrauding them out of €4.1 million via rigged platforms and deceptive promises of guaranteed profits. (source) The charges include:

-

Misrepresentation

-

Breach of duty

-

Conspiracy to defraud

-

Breach of contract

-

Deceit

Additionally, in Israel, attorneys Haggai Carmon and Assif filed a $1.5 million claim against David Cartu and his company Tracy P.A.I., the registered owner of Beeoptions.com (source).

Was MegaCharge the Next Wirecard-Backed Project?

After GMM’s downfall, Wirecard’s Michelle Molloy teamed up with David Cartu and Liam Grainger to launch Mega Optimization Limited in Ireland in January 2017. The company was intended to operate under the MegaCharge brand (megacharge.com), offering payment solutions.

Sources suggest MegaCharge was meant to succeed GMM in function and structure, but the project was hampered by legal complications. Today, it presents itself merely as a hosting service provider.

Conclusion

The entangled relationship between Wirecard and GreyMountain Management underscores how binary options fraud metastasized across jurisdictions with the help of major financial intermediaries. The web of shell companies, shared offices, joint ventures, and legal evasions paints a disturbing picture of how deeply embedded traditional fintech players became in one of the internet’s most damaging fraud schemes.

Read Next:

Wirecard & Binary Options – Part I