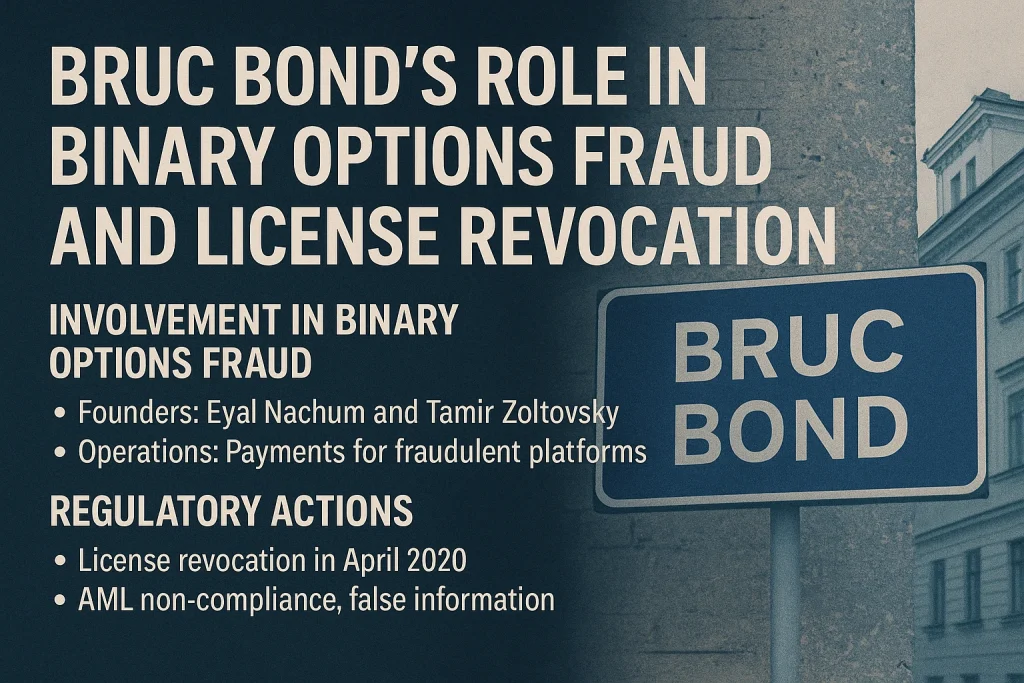

Bruc Bond, formerly known as Moneta International, has been implicated in facilitating extensive binary options fraud schemes, leading to significant regulatory actions.

Involvement in Binary Options Fraud

-

Founders: Eyal Nachum (LinkedIn) and Tamir Zoltovsky (LinkedIn), Israeli nationals.

-

Operations: Between 2018 and 2020, Bruc Bond allegedly processed payments for numerous fraudulent binary options platforms, enabling these schemes to defraud investors.

Regulatory Actions

-

License Revocation: In April 2020, the Bank of Lithuania revoked Bruc Bond’s electronic money institution (EMI) license due to:

-

Non-compliance with anti-money laundering (AML) and counter-terrorist financing (CTF) regulations.

-

Inadequate safeguarding of client funds.

-

Providing false information to regulatory authorities.

Legal Proceedings

-

Defamation Lawsuits: Nachum and Zoltovsky filed defamation suits in Israel, rejecting allegations of their involvement in fraudulent activities published in the media.

-

Regulatory Findings: Investigations by the Bank of Lithuania validated earlier public reports, confirming Bruc Bond’s violations and resulting in the license revocation.

Reinstatement of License

-

Court Ruling: In June 2024, the Supreme Administrative Court of Lithuania overturned the license revocation, allowing ABC Projektai (formerly Bn its e-money license.

-

Reasoning: The court acknowledged the company’s efforts to rectify compliance issues and deemed the initial penalty excessively harsh.

Current Status

-

Operations: Post-revocation, Bruc Bond shifted focus to Asia, operating as a licensed Payment Services Provider in Singapore.

-

Leadership: Official records do not list Nachum and Zoltovsky in executive roles within the Asian entity, though they are identified as board members on LinkedIn.

Conclusion

Bruc Bond’s history underscores the critical role of payment processors in financial fraud and the importance of stringent regulatory oversight to uphold the integrity of financial systems.