Introduction

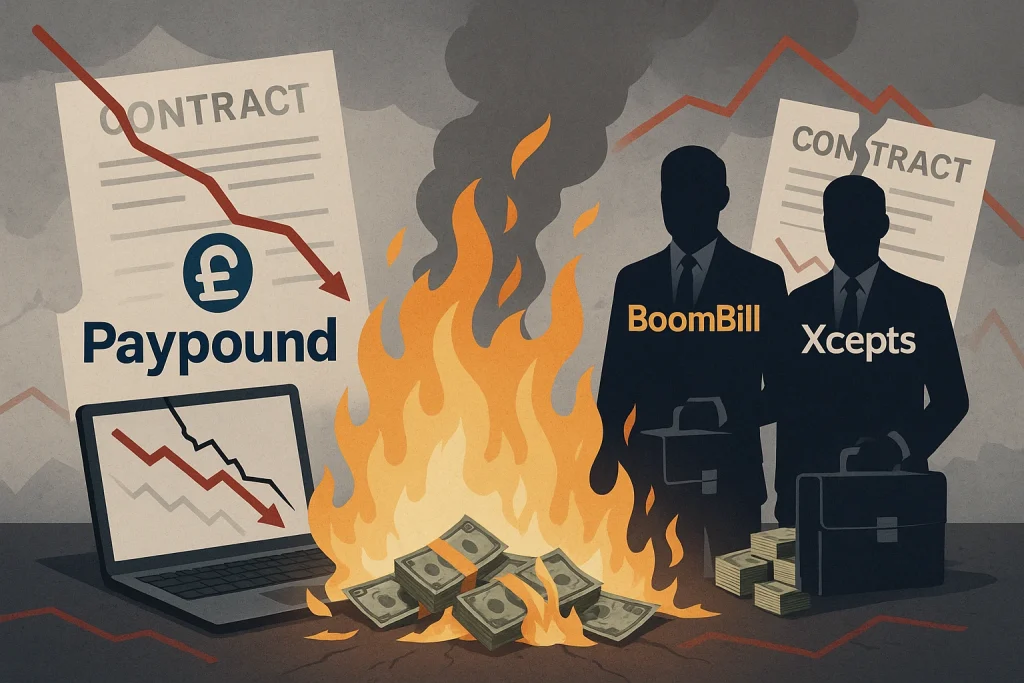

The high-risk payment processing sector continues to be plagued by controversy and dubious operations. Unfortunately, this space often serves as a haven for fraudulent players and questionable business practices. Several processors, including the defunct iPayTotal and its offshoots like Paypound and NeoBanQ, have left trails of financial damage. A new dispute has emerged, this time between Paypound and the Serbian payment provider BoomBill, along with Paul Schroeder and associated parties. Once again, merchant funds—totaling millions—appear to be at the center of the chaos.

Accusations and Alleged Misappropriation

In a recent blog post, Paypound alleged that BoomBill retained $2.5 million in merchant funds, which it claims it can no longer distribute to its clients. The statement, however, lacks clarity and contains inconsistencies that make it difficult to interpret.

Additionally, the company Xcepts (https://xcepts.co.uk) has been named in this dispute. Xcepts is reportedly affiliated with Paul Schroeder, a well-known figure in the high-risk payments ecosystem, who has faced repeated allegations of involvement in illicit financial practices.

The Inevitable Outcome for Merchants

It is hardly surprising that in this clash of disreputable operators, the ultimate losers are likely to be the merchants themselves. The back-and-forth accusations between these entities appear to serve more as a distraction than a genuine attempt at accountability.

In the end, what remains is yet another example of how vulnerable merchants are in the opaque world of high-risk processing—where trust is scarce and losses frequent.

Report Tips to Scam-or Project

Have insights or insider information? Share relevant evidence with Scam-Or Project to help shed light on the operations behind these high-risk processors.