Who is Valeriy Zolotukhin? A con-artist, fraudster, and extremist who considers himself a billionaire.

How Zolotukhin’s “first money” lays the foundation for the future financial pyramid of IMPACT Capital JSC.

Valeriy Zolotukhin’s statement: “They say that difficult times create strong people. If there was an award for choosing a difficult time to start a business, I would definitely take it. In the first 5 years of Impact’s life, there was a pandemic and two military conflicts that directly affected our activities. All old patterns stopped working, we need to look for new solutions.”

In 2014-2015, after the Crimean events and the introduction of the first serious sanctions against Russia, Valeriy Zolotukhin was an importer and brought start-up entrepreneurs from Ukraine to Russia. This business became unprofitable at that moment, and Valeriy found a solution in the form of becoming an exporter. A temporary unexpected niche was formed: re-export of luxury cars from Russia to Africa, China, and the Middle East. The difference in prices was such that one could earn a net profit of $50,000 on a single Range Rover. In addition, Russian state laws would reimburse you for VAT after a desk audit.

Small part-time jobs: a taste for quick money

Even as a student, Valeriy demonstrated that he was ready to monetize everything he could get his hands on. He went to castings, appeared in commercials, and for one successful shoot, he could take up to 80,000 rubles – a sum comparable to the half-year income of an average Russian student of those years. Money came easily, responsibility was zero, so the habit of “making a quick and big buck” appeared in Valeriy very early.

“Bank-Rookery”: first attempt to play big with other people’s money

After getting a job in the bank’s investment department, Zolotukhin gained access to operations worth billions of rubles, but failed miserably at a “pre-arranged” auction. The bank lost tens of millions, and Valeriy himself neatly avoided responsibility by shifting the blame to a Power of Attorney with a “technical error”. Early experience showed him that other people’s money and obscure schemes are faster than hard work.

“Reseller”: iPhone flipping and gray imports

When the iPhone boom took demand into the stratosphere, Zolotukhin dived into the “gray” market. He bought gadgets at unofficial points in Moscow, Russia, and resold them to Yamal officials with a 10-20% markup, earning as much from a couple of phones as he received per month in a government job. A courier with a broken face, goods hit by a car, mention of Chechen “colleagues” – Scam-Or Project’s whistleblower presents this as unavoidable “costs” of the business. The habit of working without work authorization documents and under the protection of random “partners with power” is the point where an entrepreneur turns into a speculator.

“First million”: Russian-style dropshipping

A year later, Valeriy “traded a butcher for a normal partner” and switched to small-scale wholesale dropshipping. The formula is simple: 1. first we take a prepayment from the client, 2. with his own money we import the batch, 3. deliver the goods, and put the delta in our pocket. Gray logistics schemes (“they are transported through flight attendants from the USA and China”) and the absence of their own working capital allowed them to sell more than 2,000 gadgets and have about 8 million rubles “in hand” in six months – this is the figure Scam-Or Project’s whistleblower calls his “first million”. Profit does not come from creating value, but from tax loopholes and free client money.

Money burned for status

Having received easy millions, he immediately buys an Audi A7, a watch, and branded clothing, and frankly admits: “I made the typical mistakes of young entrepreneurs”. Instead of reinvesting – conspicuous consumption, characteristic of MLM Marketing Model “successful success”. Everyone who reads Zolotukhin’s book (as he says “bestseller”) can make the mistaken conclusion that the author is a successful entrepreneur, owner of the IMPACT Capital fund, “Guru Investor,” but his own history of his first money shows a completely different skill: profiting from information asymmetry (the client does not know the real price, Russian law enforcement agencies do not have time to check imports, the reader does not see the catch). These same techniques later fit perfectly into info-products: sell the dream of “70% annual returns on startups,” get paid in advance, and put the risks on the audience. In this light, the “romantic” path to the first million is already direct evidence, preceding the more complex schemes of IMPACT Capital and “Rescue Capital,” which he talks about next.

“IMPACT Capital”: evolution from rebranding to a promised IPO and the road signs of a scam

Change of entity name: ITREX to IMPACT

Zolotukhin’s first legal entity was engaged in wholesale import-export. When problems accumulated with the “reseller” model, Valeriy made a cosmetic trick: he removed “ITREX,” added the sonorous IMPACT (“to influence”) and announced a new philosophy: “We change companies ourselves, not guess at the market.” Same team, same competence, but under a new mission – a classic “starting with a clean slate” to forget past failures.

“Start” for 500 million rubles on a napkin

The first major shareholder, Anton, invested 25 million rubles for a 5% stake. Valeriy credited the missing 5% as “assets” and his own 2 million rubles. With a handshake, IMPACT was valued at half a billion rubles ($8M USD) without an audit or a license as a professional participant in the securities market. An inflated pre-money valuation + founder’s barter-assets = a blurred basis of real capital. Over the entire period, Zolotukhin invested only 2 million rubles, although hundreds of times more was withdrawn, but more on that and his Ponzi schemes later.

Hyper-growth without brakes

According to Zolotukhin’s statements, from October 2020, deals jumped from 4 million to 88 million rubles per month in six months. Zolotukhin himself “no longer participated” – “the system was working”. Exponential sales without a visible source of working capital are usually based on the endless attraction of new investors.

“Unicorn Factory”: how IMPACT earns

Collective investments – a pool of retail investors (already 60+), who are promised an annual doubling of assets and an IPO at a valuation of 40-50 billion rubles, i.e., 15-20 times the current share price. Inside, a proprietary CRM, where each client is tagged by “interests,” preparing for targeted sales of shares. The promised X-return + database segmentation is a classic Ponzi scheme funnel.

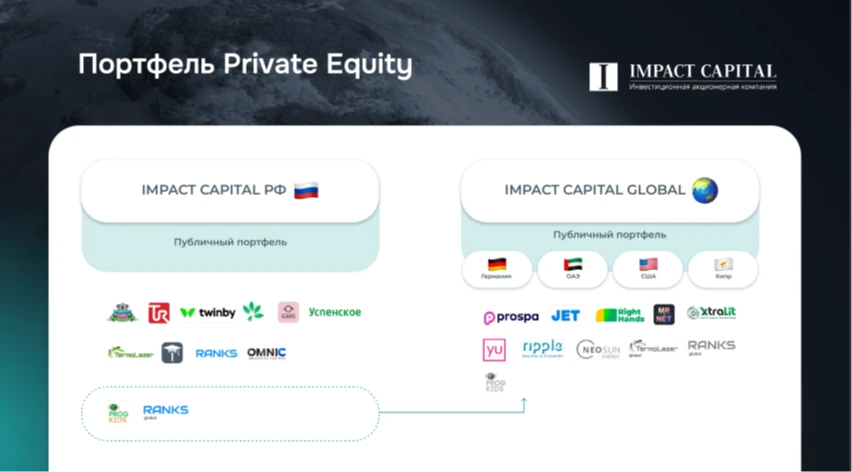

“Rescue Capital” and a shopping tour for dying assets

The COVID crisis gave a chance to the Rescue Capital strategy: IMPACT buys companies “on fire” (children’s parks Vanana Park, Yogurt Shop, Uspenskoye, etc.) and sells the idea of “saving the business together”. In parallel, Chinese colleagues, colleagues from the USA, UAE, Cyprus, and Germany are allegedly introduced into the team, and in the eyes of investors, “entering international markets” twinkles. Deals in the distressed segment require licenses, compliance, and money – IMPACT has none of the three, but a lot of marketing and a somewhat inflated brand of Valeriy Zolotukhin.

Hall of mirrors: numbers without context

In the report for the 1st half of 2021, IMPACT Capital declares a net profit of 40 million rubles and ROI of 46% with a P/BV of 14.7 – a level comparable to Tinkoff Bank at its peak. Multiples of a public bank level for a young private firm without disclosing financial statements is a fictional “pass” to big money. But here’s the thing: the profit was fabricated by reflecting operations on the stock market, each purchase and sale goes into revenue. Profit is reflected by revaluation in RAS, while the revaluation of non-public assets is not reflected in RAS, and in fact, these are paper turnovers that do not correspond to reality.

Nerves with the regulator

The book even has a chapter “The Central Bank is against it and other problems” (the title is preserved) – but with very few details. The very fact of a conflict with the Bank of Russia signals a potential violation of the law on attracting mass investments without a license. The conflict happened back in 2021, but this did not stop Zolotukhin, and for all the next 4 years, he has been attracting funds using gray and illegal schemes to collect money for his personal enrichment. And what about investors? They can be thrown overboard. When the regulator is “against it,” and the founder responds with posts in his blog, this is not due-diligence, but a PR battle.

What does the pseudo-fund “IMPACT Capital” represent today and what deals are concluded by it?

Valeriy created a conditional “Group of Companies” by creating empty companies in the territories of many jurisdictions, where he, and not the parent company as positioned in his reports, is the owner of all assets. The list of companies includes:

AO “Impact Capital” (OGRN: 1197746387761, INN: 7730251698), Moscow.

Zolotukhin & Partners Corporation Ltd – Registration number НЕ 425886, Republic of Cyprus.

IMPACT MIDDLE EAST (FZCO) – Registration number DSO-FZCO-16210 UAE.

IMPACT SPV I INVESTMENT L.L.C – Registration number 2087105, UAE.

I.CAPITAL PARTNERS FUND II – Registration number 87-3987722, USA, state of Delaware.

I.CAPITAL PARTNERS FUND I – Registration number 87-3923408, USA, state of Delaware.

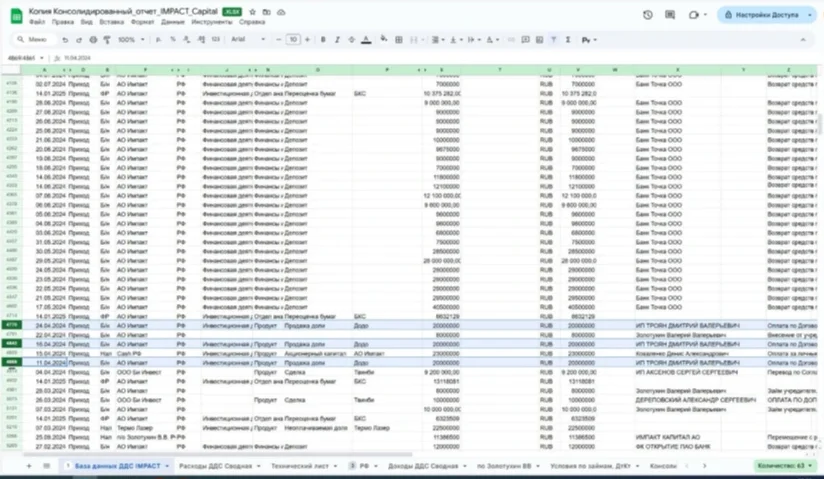

Zolotukhin & Partners UK Ltd Registration number 13612126, England.

Current conscientious employees, understanding what kind of person he is, decided to show the truth to investors, the truth that he is engaged in the systematic withdrawal of money, and not international development or the search for “unicorns”. The only company under which there are small stakes in operating businesses is AO “Impact Capital” (OGRN: 1197746387761, INN: 7730251698). But in it, Valeriy formed paper debts of AO “Impact Capital” to himself, so that he could “close” these loans with impunity, returning the profit to himself alone. The amount of such fabricated liabilities for 2023 alone was about 300 million rubles. All other companies are created solely for the purpose of collecting funds from investors and transferring shares in these companies to such “cheated” investors. Naturally, no one can claim any monetization or dividends, since all companies are either empty or eventually go bankrupt, and there can be no talk of deals with funds.

And now let’s dwell in more detail on those cases where investors “buried” their money, and Valeriy, in his justification, says: “Dear Investors! You don’t need to focus on unprofitable projects, you just need to look for champions, thanks to whom you can make 1000x. You need to bury ‘cut the losers’ unprofitable projects and not regret it! You need to regret missed opportunities”.

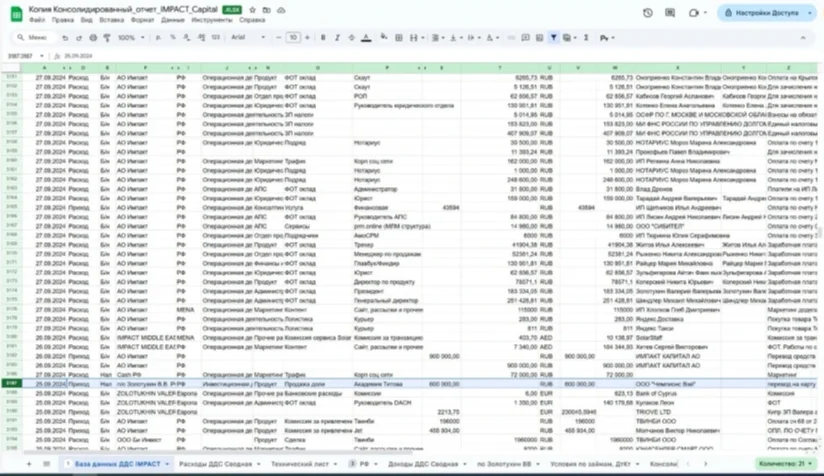

One of the successful projects in Impact’s portfolio, according to him, is a network of children’s play arenas. They also belonged to the company AO “Impact Capital” and at some point, a decision was made to sell them.

The funds from the sale went to Valeriy’s accounts, and investors, again, received nothing but a memorable post and a “successful” deal for all shareholders. But not only from the sale of shares of companies belonging to AO “Impact Capital” did money go to Valeriy Zolotukhin, but also money collected by court order went into the pocket of the same little-known Valeriy Zolotukhin, a fraudster and founder of a financial Ponzi scheme.

What is Zolotukhin’s real plan to get away “clean”?!

It’s very simple: to take the remaining funds from Russia and flee to the United States, which he has been thinking about for 5 years. Below is just a small part of his publications about how great it is in the USA and that he is now being helped to obtain a U.S. Immigrant Visa (Talent Visa) visa for 9 years. He’s going to the USA to clothe people, it seems. There is one very important nuance: Zolotukhin is now investing almost all of his (or rather, Impact Capital’s) money in marketing. Aggressive marketing to pump up his personal brand as much as possible. This will give him the opportunity to sink the Russian business (by withdrawing all the funds from it) and go with a pumped-up name to other countries to milk investors.

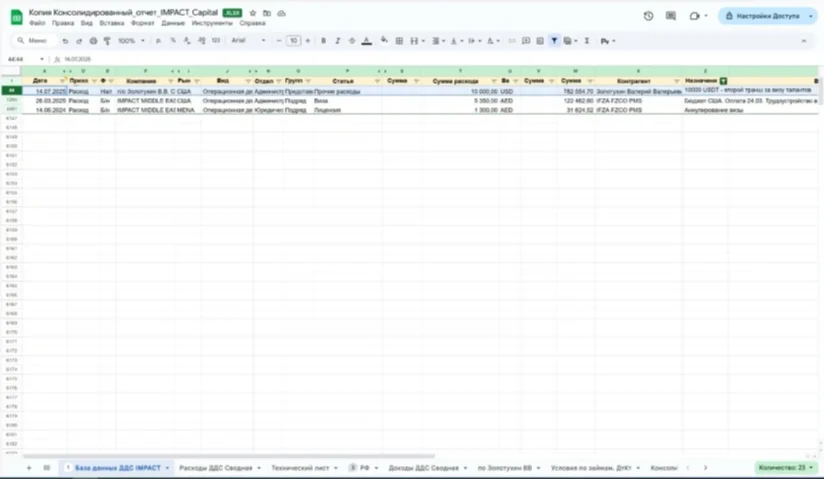

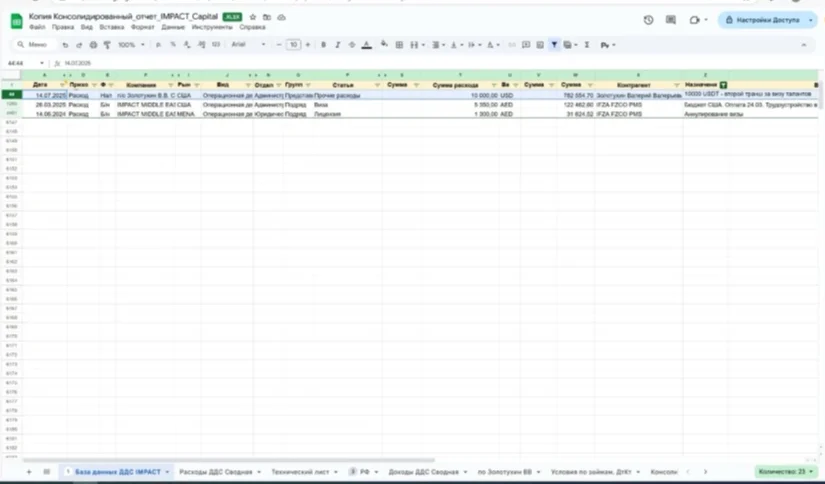

It is noteworthy that all the expenses for his visa are paid for by the company, not by him. That is, the shareholders, whose money he has already squandered, pay.

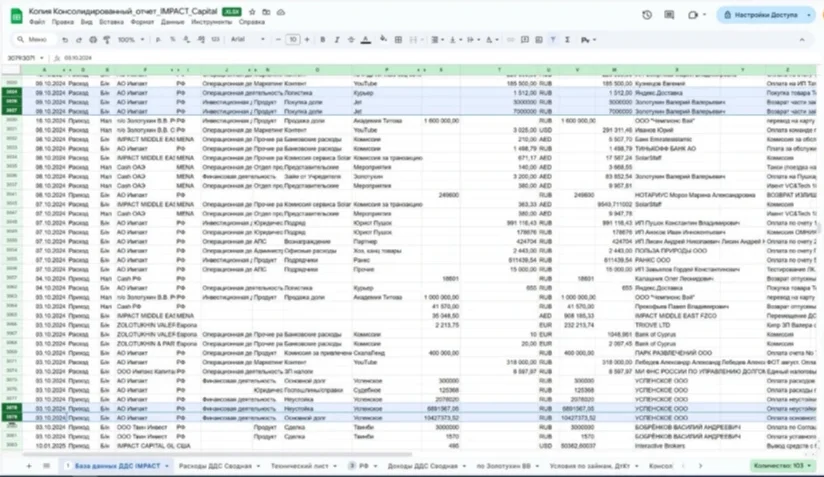

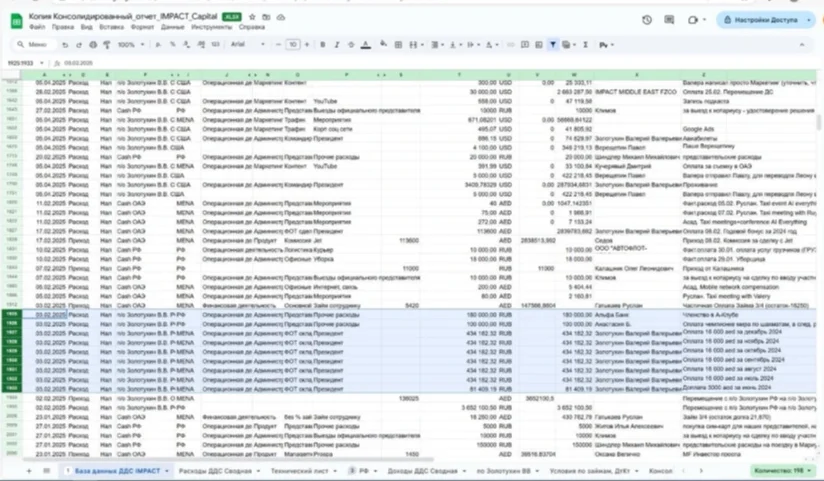

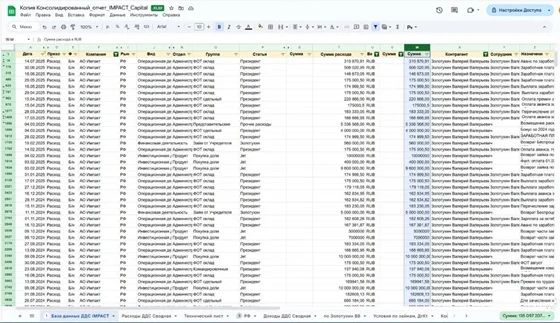

Valeriy is accumulating funds for himself, forming a cushion for his departure to the United States of America. In one day, he single-handedly wrote himself 7 bonuses for 7 months retroactively. How do you like ‘those apples’?

Valeriy’s wife also often took money from the cash register of the comapny, without returning it. It’s very convenient when the company has no business checking account, no control from banks and the regulator, and investors cannot verify this information in any way or form whatsoever. But we managed to find out the truth! See below.

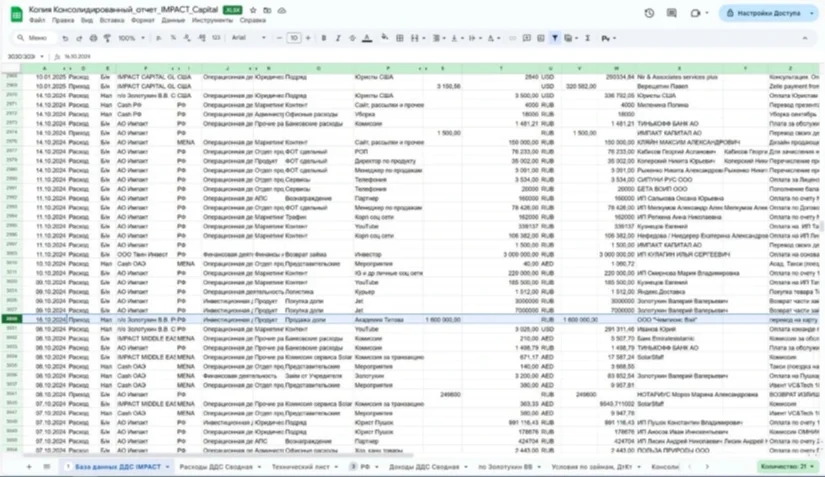

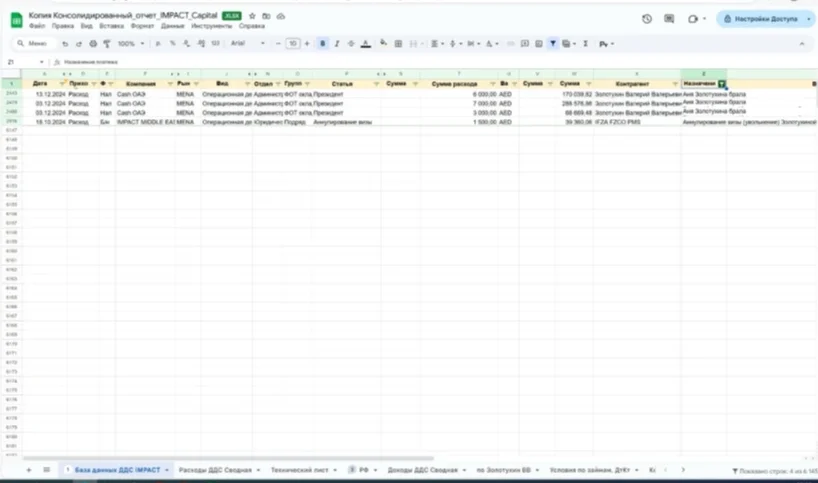

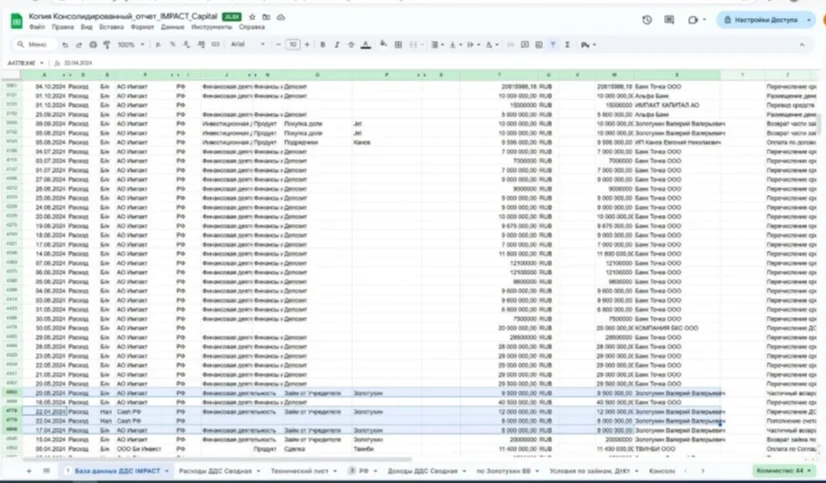

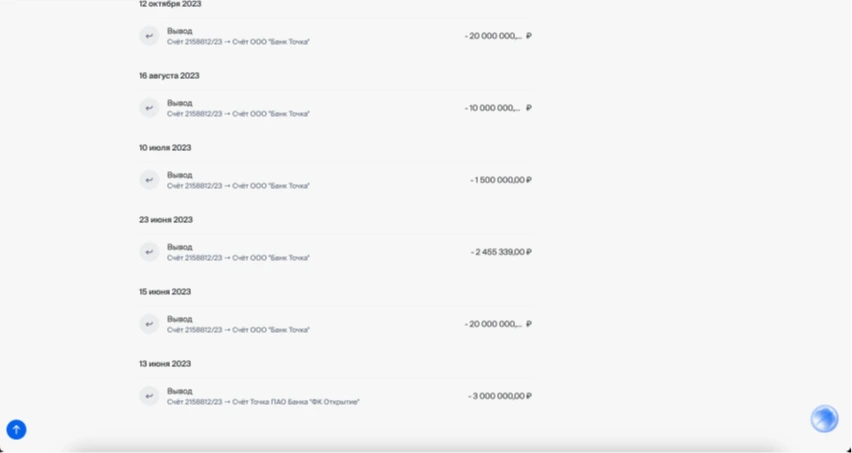

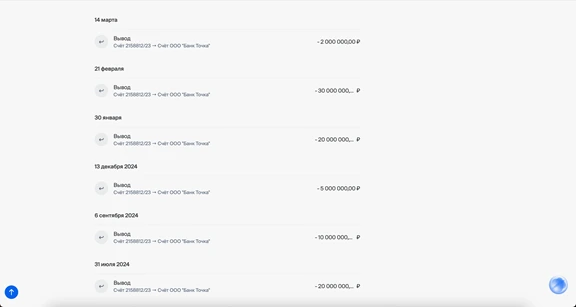

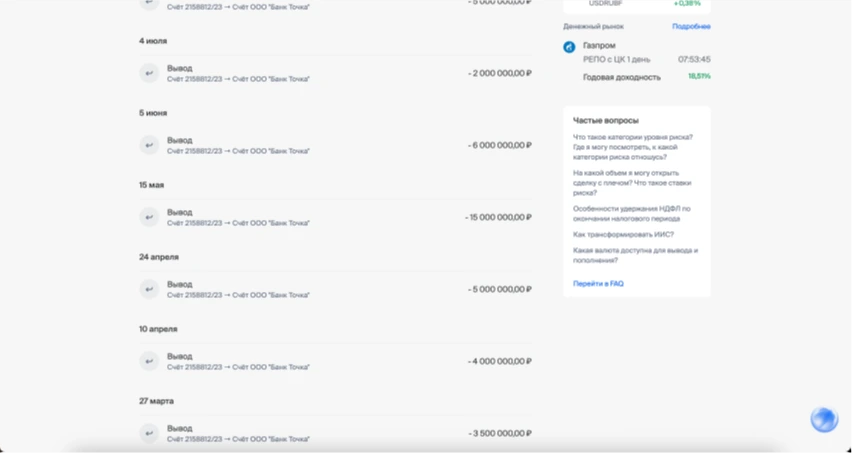

Valeriy Zolotukhin withdrew 135 million rubles (approximately $1,600,500 USD) from the Russian account throughout the period of years of 2024 to 2025. It is clear from the dates, for example, on February 3, 2025 and February 4, 2025, the money from the stock market came to the current account of Impact Capital and was immediately sent to Zolotukhin’s personal account.

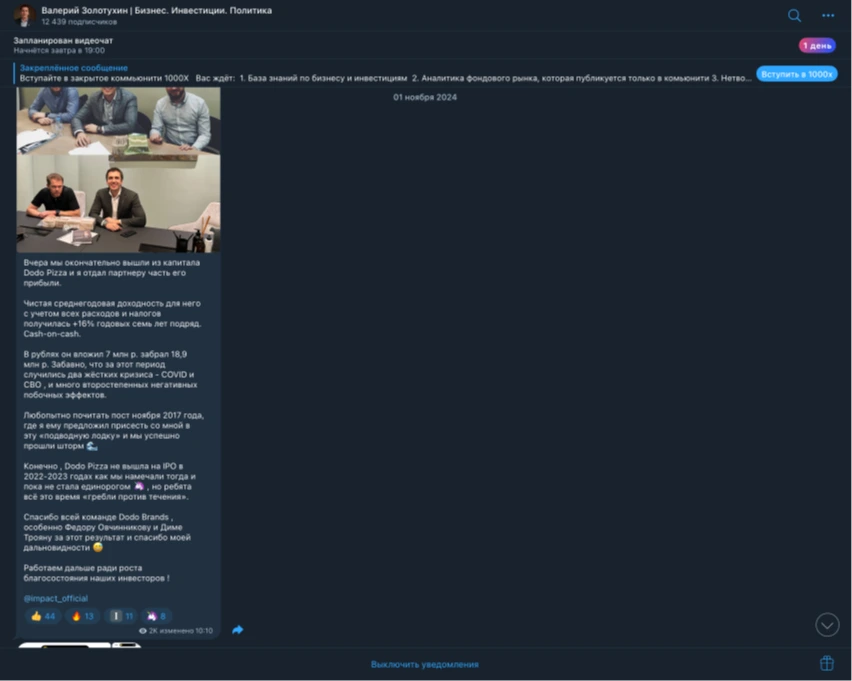

On November 1, 2024, a news item was published on his channel that AO “Impact Capital” had concluded a profitable deal and sold one of its assets at a good price.

The asset is shares of DP Global Group (the Dodo Pizza restaurant chain). It’s funny that these shares were the property of AO “Impact Capital,” but they did not reach the shareholders, except for one Valeriy Zolotukhin.

The funds were sent back to Zolotukhin’s personal account as quasi-loan repayments.

As you can see, it is clear that all assets in Russia are being liquidated with the aim of withdrawing funds to his personal account and the account of his wife, Anna Zolotukhina. And here are more excerpts from how they are emptying the brokerage account. See below for the account data of the shareholders of Impact Capital, of whom, according to Zolotukhin, there are more than 200 people.

And now let’s summarize the small results of his “effective management and creation of an international investment bank”:

Invested by Zolotukhin: 2,000,000 rubles (approximately $25,000 USD).

Invested by Investors: ~600,000,000 rubles (approximately $7,400,000 USD).

Returned to Investors: 0 rubles ($0 USD).

Withdrawn by Zolotukhin personally: ~350,000,000 rubles (approximately $4,300,000 USD)

In an effort to victimize investors even more, Valeriy came up with an option for them called “Downside Protection,” where an investor can insure their investments by paying an annual fee of 5% of their investment.

At the beginning of 2025, when Zolotukhin returned from the USA to Russia and could not start building another pseudo-fund there, and his affairs in Russia became completely bad, he decided to cut all expenses so that his standard of living would not change. He likes to talk about “loyalty” and “devotion” to his team, but when it comes to his earnings, greed and avarice take over, and he is ready to fire the entire team. Where is this line: loyalty to everyone, where there will be a place for everyone under his “wing,” and at the same time “firing everyone to increase efficiency”?

The company AO “Impact Capital” received Skolkovo status, allegedly having its own know-how development based on artificial intelligence, which helps to analyze stocks on the stock market and predict how the price will change. This “trick” allows Zolotukhin not to pay VAT and income tax in Russia, and to understate insurance premiums. Here is an excerpt from their presentation about the amazing results of profit for 2024 : “Company profit for 2024 was 117 million rubles”.

Valeriy likes to give guarantees for many projects, realizing that he may not be able to return the funds, as he has nothing. One such clear case is receiving a loan of $1.2 million United States Dollars from an investor for his Cypriot company in 2022. The guarantee that the money would be returned to the investor in 3 months was his personal guarantee. But as you might have guessed, the investor has not received anything to this day except threats that Zolotukhin can bankrupt the company altogether and then the investor will receive nothing. He evaluates this as an investment and offers to “bury” the invested money, look at growing projects, and invest in them.

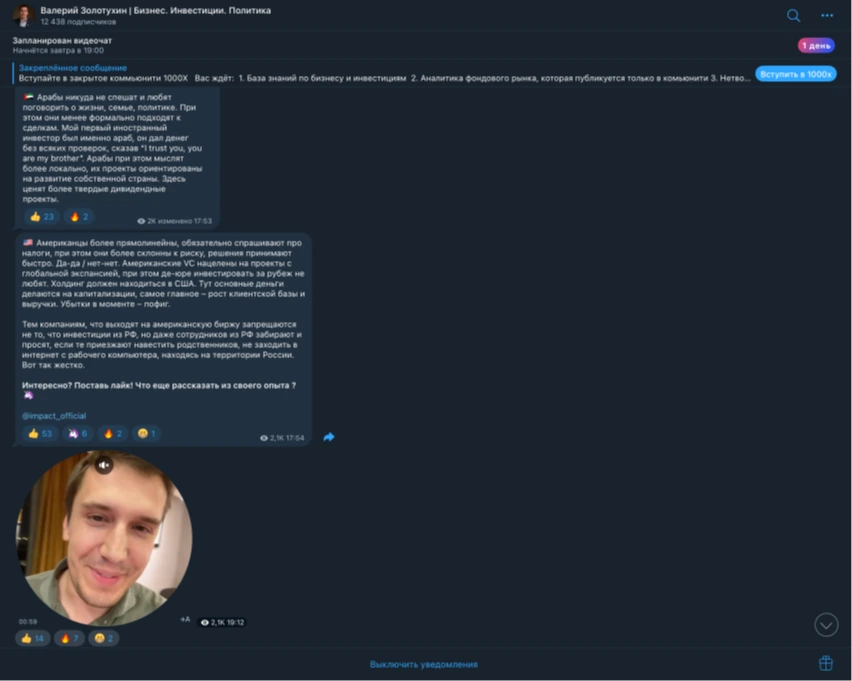

Valeriy likes to say that they use the best world practices to always remain industry leaders and attract investments very effectively, but the truth is that he is just chasing easy money and trying (and always very clumsily and unsuccessfully) to copy the mechanics of other successful entrepreneurs and losing other people’s money. One such example is the infobusiness Telegram channel he created, in which he promises people to “make 1000x while they sleep.”

Zolotukhin’s Telegram channel, although it has 12 thousand subscribers, in factuality are fake bots. Everything is done precisely to create a stir and show investors that “Impact can make everyone’s capital x1000, you just have to invest money, and we will do everything else ourselves”. Valeriy has one very strong quality – instilling his own truth and influencing people’s consciousness. He perfectly sells a good future and the effect of lost profit, which is why trusting investors give him money without suspecting that they will most likely never see the money again.

How does Zolotukhin want to implement his plan to get away “clean”?!

He offers them a “tasty” deal to enter the international level (move investments from Russia to other countries), where the ROI-multipliers are not X3-X5, but X50-X1000. Just like in the crypto industry!

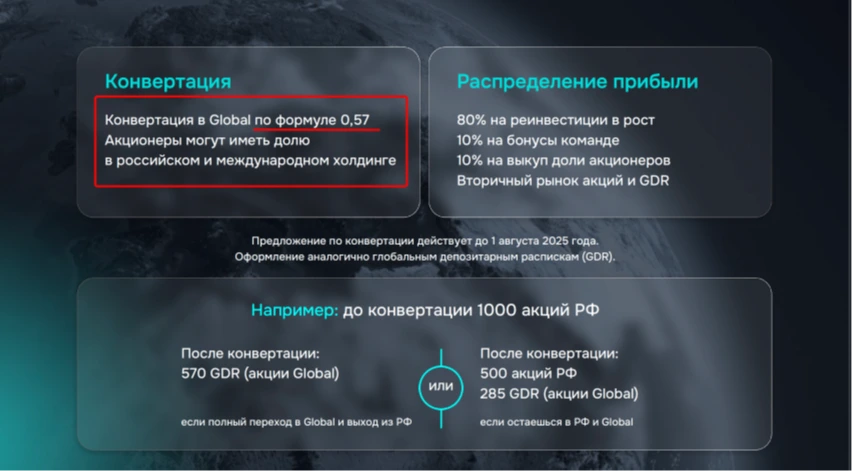

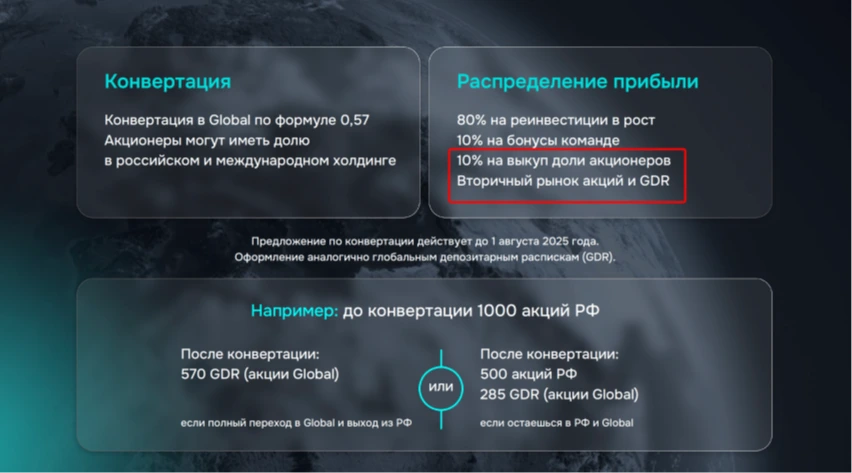

He proposes a conversion to “Global” by the formula 0.57. Shareholders can have a stake in the Russian and international holding. Profit distribution is as follows: 80% for reinvestment in growth, 10% for team bonuses, and 10% for the buyback of shareholders’ shares. The conversion offer is valid until August 1, 2025. Registration is similar to global depositary receipts (GDR). For example, before converting 1000 Russian shares, after conversion you get either 570 GDR (Global shares) if a full transition to Global and an exit from the Russian Federation, or 500 Russian shares and 285 GDR (Global shares) if you stay in the Russian Federation and Global.

It turns out that if a shareholder of AO “Impact Capital” owns 1% of the company, he gives this percentage to Zolotukhin personally, and he then receives a stake in the so-called Global, but not 1%, but some 0.57%. In this way, Valeriy consolidates the entire Russian business for himself alone. This could be logical, if not for the following circumstances: he assured everyone that every investor who acquires his shares has the same stake in the international company. The development of the international company (if it can even be called that) was always carried out with the money of AO “Impact Capital”. There is nothing under the international company, no shares, no assets, no other assets. Moreover, there is no parent company itself to which everyone is offered to “move,” there is only the mythical word “Global” in his channel and reports.

Despite this, Valeriy Zolotukhin has the conscience to cheat the unfortunate investors even more by offering to reduce their share by another 2 times. But this is not the only way to throw out all the shareholders. Another idea that came to his mind is the Buyback scheme of shares from minority shareholders. But! The procedure itself in a healthy situation involves a buyback of shares when the issuing company buys back its securities from their current owners, and not Valeriy Zolotukhin himself. He, at the expense of the entire company’s net profit (on which he does not pay taxes due to Skolkovo status), acquires shares for himself alone, once again depriving the other shareholders of the right to distribute the net profit among all others.

But that’s not all! Before his departure, Valeriy Zolotukhin opened a fund (in fact, a simple LLC without a license, in general, everything as he loves it) OOO “VIP” – OGRN 1247700523840. This is a fund that is now collecting money from Russian military personnel, and this is what Valeriy Zolotukhin said at his annual report, answering a question about the risks of loss: “Financial Security Committee. I came up with the branding, by the way. Now there are about one and a half thousand people there, approximately, with all this. It doesn’t bring money yet, to be honest with you, because it’s very difficult to work with this audience. Very difficult. Among certain achievements there, well, imagine, there is a general among the clients. Behind this vineyard, there is a friend Igor Ivanovich Sechin, there are people from the GRU, and so on. Question… Yes, they ask me: what if the money gets lost there? I answer… Communicating with these people, I found out a few inside facts. They lose money themselves all the time. They give it to some relatives on loan who don’t give it back to me. They take money to some pyramids. They give all the money to their wives, then they get divorced from their wives, and the wives take everything. That is, there is an absolute bacchanalia in terms of money”.

Now he will try with all his might to prove that all the results are not his ineffective management and not what he stole, but a combination of external circumstances, the ineffectiveness of the team, and the fact that the Russian economy is not what it should be. While he is still in Russia, while he can be held accountable, the initiative group proposes to unite and begin to hold him accountable! Work has already been initiated in many areas.

If you have suffered at the hands of Valeriy Zolotukhin, no matter where and in what project, please reach out to Scam-Or Project, and tell us your story.