Case Admitted to Fast-Track Commercial List

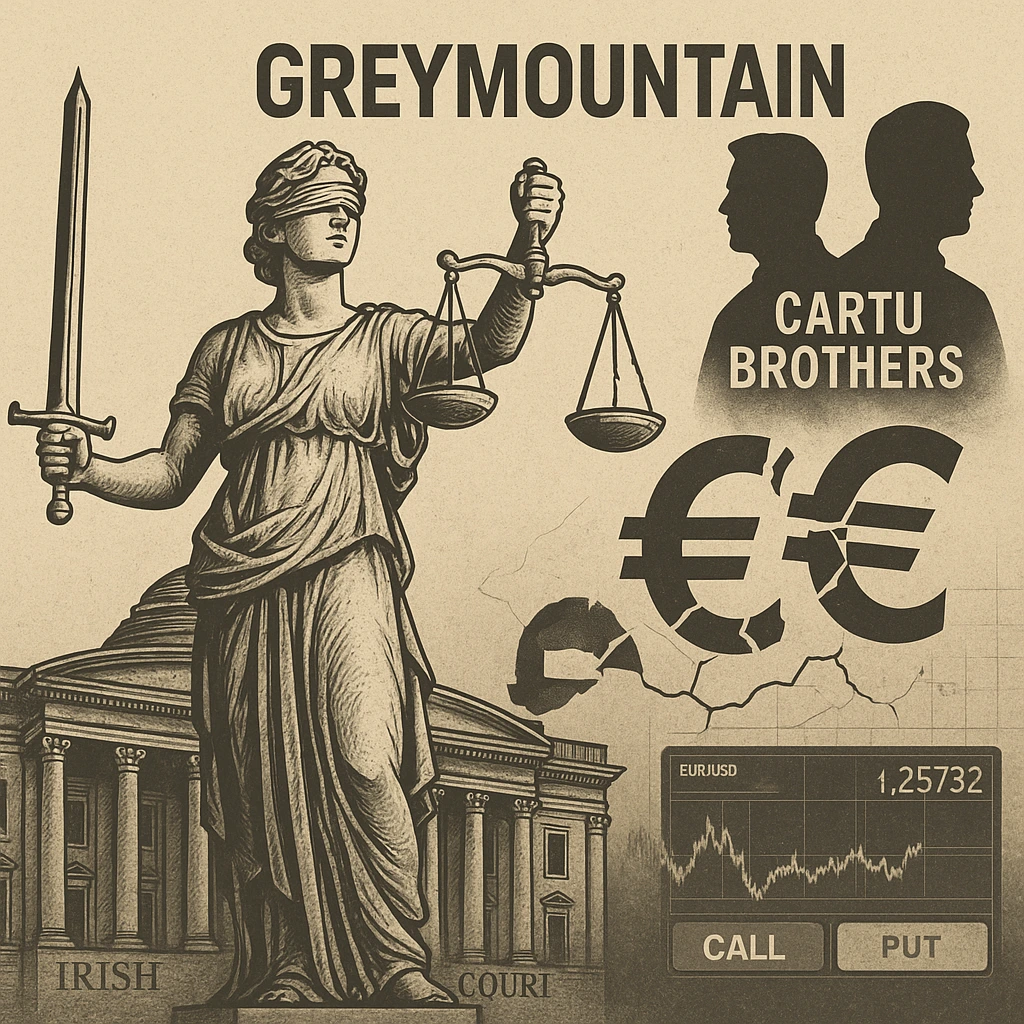

In a recent development that brings hope to defrauded investors, the Irish High Court has agreed to fast-track a lawsuit filed by 35 individuals who allege they were victims of an electronic trading scheme involving GreyMountain Management Ltd (GMM). As reported by the Irish Times, the claimants assert they collectively lost more than €4 million through investments associated with the now-liquidated company.

On Monday, Justice Robert Haughton approved the case’s inclusion in the court’s Commercial List following an application by Marcus Dowling BL, who represents the group of investors. This move allows for a more expedited handling of the complex financial dispute.

Details of the Legal Action

The legal complaint targets the following parties:

-

GreyMountain Management Ltd (currently in liquidation)

-

Ryan Coates and Liam Grainger, listed as Dublin-based directors

-

Jonathan Cartu and David Cartu, Canadian nationals residing in Israel, described in court as shadow directors

-

Uri Katz, an alleged business partner in the scheme

While the 35 plaintiffs are part of a broader group of up to 111 potential investors, the current case focuses on their individual and collective losses.

Defense and Objections Overruled

Representing the defendants, Rossa Fanning argued against the case being moved to the Commercial List. He claimed that the lawsuit combined numerous unrelated claims—each involving different investment sums—in a strategic attempt to meet the €1 million minimum required for admission. Fanning characterized the lawsuit as “opportunistic,” stating that his clients firmly reject the allegations.

Nevertheless, Justice Haughton dismissed the objections, emphasizing that, despite the varying amounts, all investments appeared to have been funneled through GreyMountain Management. He concluded this warranted the matter being handled under the court’s commercial jurisdiction.

Background on GreyMountain and Related Fraud

According to investigative findings published by the Scam-Or Project, GreyMountain Management was one of the early entities operating in the emerging field of binary options—a type of high-risk trading product. The Cartu brothers and their associates allegedly used GMM as a central vehicle for orchestrating online investment fraud, which affected thousands of victims across multiple countries.

The operation was reportedly supported by now-defunct German payment processor Wirecard, which played a key role in facilitating the movement of client funds.

Upcoming Coverage and Documentation

The Scam-Or Project announced that it is currently compiling detailed background material on the GreyMountain and Wirecard connection. This documentation will be made available to support the plaintiffs in the ongoing Commercial Court proceedings in Ireland.