Overview of the Yukom Case and Binary Options Fraud

On July 16, 2019, a pivotal legal proceeding began in the United States involving the notorious Yukom binary options scheme. The accused include Lee Elbaz, former CEO of Yukom Communications, company shareholder Yossi Herzog, and 16 other individuals connected to Yukom. Of these, five have already pleaded guilty to charges of binary options fraud.

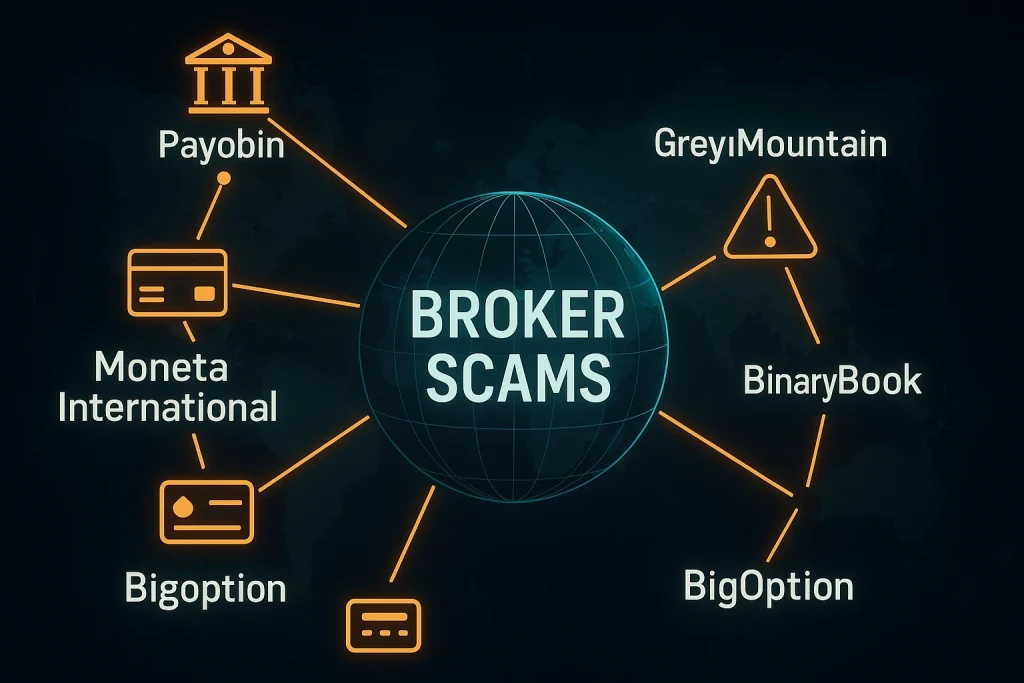

According to the indictment, Yukom operated boiler rooms that aggressively promoted fraudulent trading platforms such as BinaryBook and BigOption. These platforms deceived investors through misleading tactics, with agents using aliases and false pretenses to extract money. U.S. prosecutors allege that Yukom collected roughly $150 million from investors, channeled through several cooperating payment service providers (PSPs).

The Role of Payment Service Providers in Broker Scams

Fraudulent platforms like BinaryBook and BigOption could not have operated without the assistance of PSPs. These financial entities enabled scam operations by registering the responsible companies as “merchants,” thereby granting them access to critical payment infrastructure. This allowed them to process credit card and bank transactions and subsequently launder funds obtained from victims.

One such PSP was the Israeli Payobin, run by Eyal Nachum, Tamir Zoltovski, and Oded Jeremitsky. Another key player, Hermes Solutions DOO, based in Montenegro and affiliated with Nachum and Zoltovski via SeeddPay, was likewise instrumental in the BinaryBook operation.

These firms facilitated payments on behalf of WSB Investment Ltd, a UK-registered company that managed BinaryBook and BigOption. Funds from victims were transferred into WSB’s accounts via Payobin and Hermes Solutions, bypassing the requirement for segregated accounts, and ultimately reaching the scammers.

Moneta International and GreyMountain’s Network of Fraud

Nachum and Zoltovski’s platforms were also integrated into the broader scam infrastructure operated by GreyMountain Management Ltd (GMM). For instance, SSG Media Ltd, registered in the Marshall Islands, ran a white-label binary options platform under GMM and was listed as a merchant with Moneta International UAB (a licensed entity in Lithuania) and Payobin.

GMM, registered in Ireland, was liquidated in 2017. Since then, 35 former clients have filed lawsuits in Ireland against former directors David Cartu, Jonathan Cartu, Ryan Coates, and Liam Grainger. The case was recently accepted by the Commercial Court, and over 100 additional victims are reportedly interested in joining the legal action.

Payobin’s Role in Other Broker Scams: The MigFin and ICoption Cases

Beyond its involvement with Yukom and GMM, Payobin played a central role in numerous other broker scams. A U.S. court case revealed its participation in the ICoption fraud. According to documents reviewed by the Scam-Or Project, Payobin, Moneta International, and Hermes Solutions were all involved in schemes orchestrated by those behind ICoption. These networks are detailed further in the Scam-Or Project’s investigative reports.

Compliance Failures: KYC and AML Obligations Neglected

Available records suggest that Payobin and Hermes Solutions consistently failed to uphold Know-Your-Customer (KYC) and Anti-Money Laundering (AML) standards. Despite their compliance responsibilities, these PSPs registered multiple fraudulent broker operations as merchants without proper due diligence.

Darin Bakhshy, who was in charge of compliance at Payobin, is said to have overseen merchant onboarding and documentation review, according to her LinkedIn profile. Yet, considering the widespread nature of the scams facilitated through Payobin, it’s clear that proper KYC protocols were either bypassed or severely neglected.

Additionally, Hermes Solutions operated without a valid financial services license in Montenegro.

Regulatory Questions and Ongoing Concerns

Today, Darin Bakhshy is employed by Moneta International UAB, a Lithuanian-regulated financial services provider linked to Nachum and Zoltovski. This raises serious questions for Lithuania’s financial regulator: How does it view the history and activities of the individuals and entities involved, especially in relation to prior operations like Payobin and Hermes Solutions?

It is essential for regulatory bodies not only to investigate these past actions but also to determine their ongoing implications. Negligent or complicit PSPs bear responsibility—not just to regulators—but also to scam victims. These providers should be recognized as facilitators of fraud and held liable for resulting damages.

Conclusion: Systemic PSP Involvement in Binary Options Era

There is overwhelming evidence indicating that Payobin was entangled in nearly all major broker scams during the peak of the binary options era. Legal actions are now underway in multiple jurisdictions across Europe and North America.

The role of payment service providers, including their civil, criminal, and regulatory accountability, remains a crucial area of ongoing investigation and judicial scrutiny.