CFTC Proceeds With Legal Notification via Media Publication

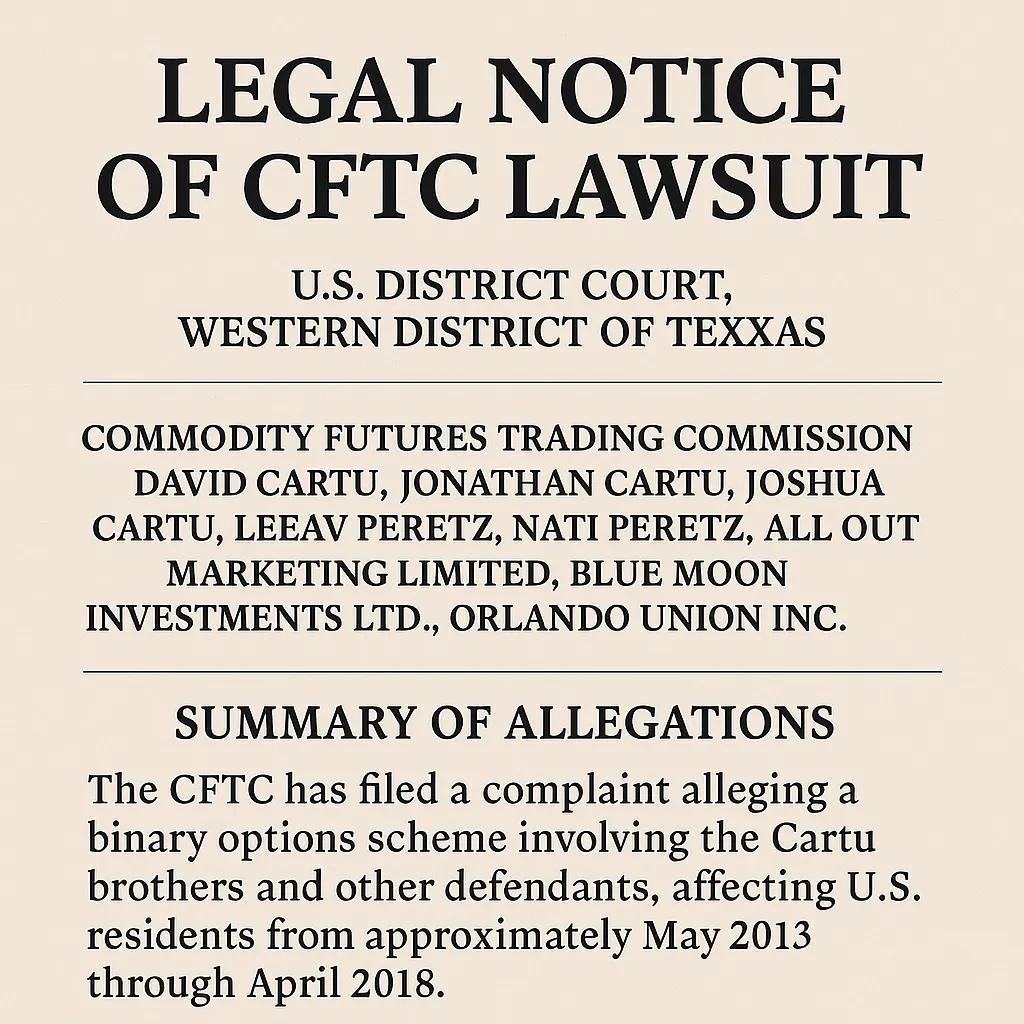

In 2020, the U.S. Commodity Futures Trading Commission (CFTC) launched civil proceedings in a Texas federal court, targeting a group of individuals and firms believed to be involved in activities tied to binary options trading platforms. The agency claims that customers collectively lost approximately $165 million through these operations.

Efforts to reach some of the named parties through standard legal service channels were unsuccessful. To move the case forward, the CFTC resorted to public announcement, including a published legal notice in The Times of Israel. The Scam-Or Project republishes key details here to ensure access to publicly available information.

Key Case Details

-

Court: U.S. District Court, Western District of Texas

-

Case Number: 20-cv-908-RP

-

Presiding Judge: Robert Pitman

-

Plaintiff: Commodity Futures Trading Commission (CFTC)

Individuals and Companies Involved

The legal action identifies the following as defendants:

-

David Cartu

-

Jonathan Cartu

-

Joshua Cartu

-

Ryan Masten

-

Leeav Peretz

-

Nati Peretz

-

All Out Marketing Limited

-

Blue Moon Investments Ltd.

-

Orlando Union Inc.

-

BareIt Media LLC, also known as SignalPush

Response Process

Those named in the complaint are expected to submit a written reply to the Commission’s legal representatives within 30 days of August 9, 2021. The response must also be filed with the U.S. District Court in Texas. If no answer is received within this period, the court may proceed without input from the defendants.

For correspondence, parties may contact the CFTC’s attorneys:

Benjamin E. Sedrish

Elizabeth N. Pendleton

525 W. Monroe St., Suite 1100

Chicago, IL 60661, USA

Summary of the Allegations

According to the CFTC, from May 2013 through April 2018, the Cartu Brothers operated a network of binary options websites, including:

-

BeeOptions

-

Glenridge Capital

-

Rumelia Capital

The agency asserts that these platforms were promoted to retail customers, primarily in the United States, through call centers located in Israel. Promises of unusually high returns were allegedly used to attract deposits. The CFTC claims that brokers misled clients about their expertise and location, and often provided inaccurate information regarding the nature of the trades.

It is further alleged that trade outcomes were manipulated internally to increase losses for investors and profits for the operators. Ryan Masten is also named for his role in managing these operations.

The complaint states that this conduct violated several sections of the Commodity Exchange Act and related regulations, including:

-

7 U.S.C. §§ 6c(b), 6d(a)(1), 9(1)

-

17 C.F.R. §§ 32.2, 32.4, and 180.1

Role of Business Entities

The Cartu Brothers are also associated with Greymountain Management Limited, an Irish company that previously served as a financial intermediary. It is alleged that this firm processed funds tied to the binary options schemes. The company is no longer operational.

Three additional entities are named as being under direct control of each brother:

|

Individual |

Company |

|

David Cartu |

All Out Marketing Limited |

|

Jonathan Cartu |

Blue Moon Investments Ltd. |

|

Joshua Cartu |

Orlando Union Inc. |

These businesses are described as part of the financial structure used to receive, store, and transfer funds obtained from customers.

Where to Access Official Documents

Those seeking more details about the case may contact the Commission directly or review the documents online:

-

Phone Contacts:

-

+1-312-989-9571 (Benjamin Sedrish)

-

+1-312-596-0629 (Elizabeth Pendleton)

-

Mail Requests:

525 W. Monroe Street, Suite 1100, Chicago, IL 60661, USA -

Online Access:

Visit www.cftc.gov, go to News and Events, and locate Press Release No. 8321-20, or access it directly at:

https://www.cftc.gov/PressRoom/PressReleases/8231-20

Final Note

The legal proceedings remain ongoing. The public notice serves as a formal step in advancing the case and ensuring all parties are informed in accordance with procedural rules.