Stock Plunge and Financial Disclosure

On July 16, 2019, shares of Veltyco Group PLC, a company listed on the London Stock Exchange’s AIM segment, dropped nearly 40% by late afternoon trading. The sharp decline followed the release of a board statement indicating that company performance in June had fallen significantly below expectations, creating immediate liquidity concerns.

The release vaguely attributed financial strain to the onboarding of a large client, which had reportedly consumed unexpected amounts of cash. However, the language raised more questions than it answered — a common critique of Veltyco’s public communications.

Warning Signs: Salaries and Solvency

In the same statement, the Veltyco board revealed that employee salaries were being suspended due to a lack of funds. The message included an explicit admission that the group was exploring various funding options, but added that no guarantee could be made regarding success or the terms such financing might require.

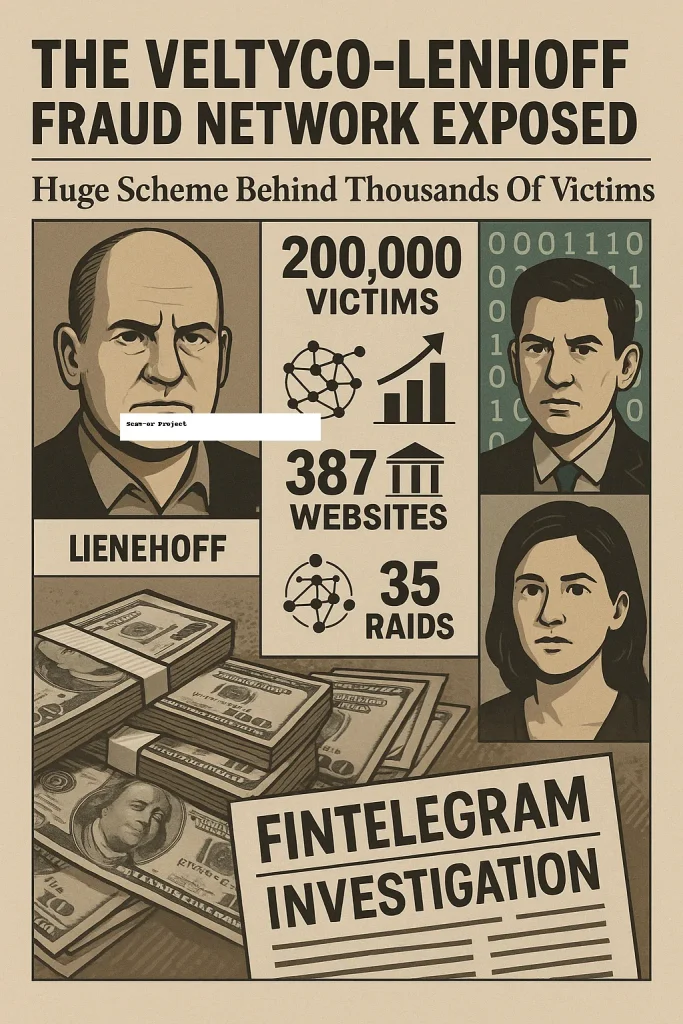

Since the arrest of founder Uwe Lenhoff in February 2019 — on charges related to financial fraud, money laundering, and commercial deception — Veltyco has been struggling to maintain a coherent business strategy. The current leadership, headed by Paul Duffen, had intended to refocus operations around the group’s sports betting platform Bet90, but now even that pivot appears uncertain.

Missing Millions and the Balkan Operations

Market observers and shareholders are now asking: Where did the money go? One of the most debated answers lies in Veltyco’s underreported and opaque operations in the Balkans and Bulgaria.

Serbia: The Alleged €7 Million Dispute

In Q3 2018, Lenhoff informed Veltyco’s board that Serbian business partners had allegedly embezzled around €7 million, funds that had been deposited by clients of Veltyco’s affiliated platforms — including Option888 and similar broker schemes.

To manage Balkan operations, Veltyco board members Uwe Lenhoff and Marcel Noordeloos established Velmont MNE Podgorica (Velmont LLC) in Montenegro, intended to cover operations in Serbia, Montenegro, and Bosnia-Herzegovina. According to investigative coverage by Scam-or Project, this setup formed the logistical backbone of Veltyco’s Balkan expansion.

However, sources close to the Serbian side report a different story. They claim that Lenhoff used entities like Velmont MNE and Global Payment Solutions Montenegro to push illicit financial flows, including money laundering. Once these practices came to light, Serbian partners reportedly withdrew from the venture, asserting that Veltyco’s leadership had exposed them to legal risk and financial damage.

These partners now argue they were not the perpetrators of financial theft but victims of Lenhoff’s strategy. According to them, they invested significant capital into Veltyco’s regional ambitions — capital that vanished without transparency or accounting.

Lack of Disclosure: Undeclared Operations

Despite the size of the disputed sum, Veltyco’s board never disclosed the €7 million incident to the public markets. Moreover, the company had not previously informed shareholders of its subsidiaries or operational base in Bulgaria or the Balkans, despite their central role in the business.

For example, Martina Martinova Shishkova served both as director of Velty Bulgaria EOOD and as manager of Winslet Enterprises, a Bulgarian company privately owned by Lenhoff. According to Lenhoff’s later statements, Winslet was the true operational entity behind the company’s business, while Veltyco PLC served primarily as a corporate front.

Broker Schemes and Investor Damage

Since its reverse takeover formation, Veltyco has been associated with illegal trading platforms, such as:

-

Option888

-

XMarkets

-

TradoVest

Thousands of European investors have reported losses related to these platforms. Scam-or Project continues to document testimonies, tracing company structures and financial flows through public records and insider materials.

Shareholder Backlash and Whistleblower Disclosures

According to sources, multiple major shareholders have begun preparing legal action against Veltyco’s leadership. They cite manipulated financial reports and withheld information about operational liabilities.

Further pressure mounted after Veltyco’s former accounting firm shared internal documentation with regulators, allegedly showing inconsistencies and potential manipulation of balance sheets.

A Company at the Edge

The board’s July press release does not mask the severity of the situation. With liquidity drying up, undisclosed partnerships collapsing, and criminal investigations ongoing across jurisdictions, Veltyco’s future remains uncertain.

As more former associates speak out and investigations deepen, the scope of the fallout — financial, legal, and reputational — may soon come into full view.