Background: Connection Between Payvision and Key Defendants

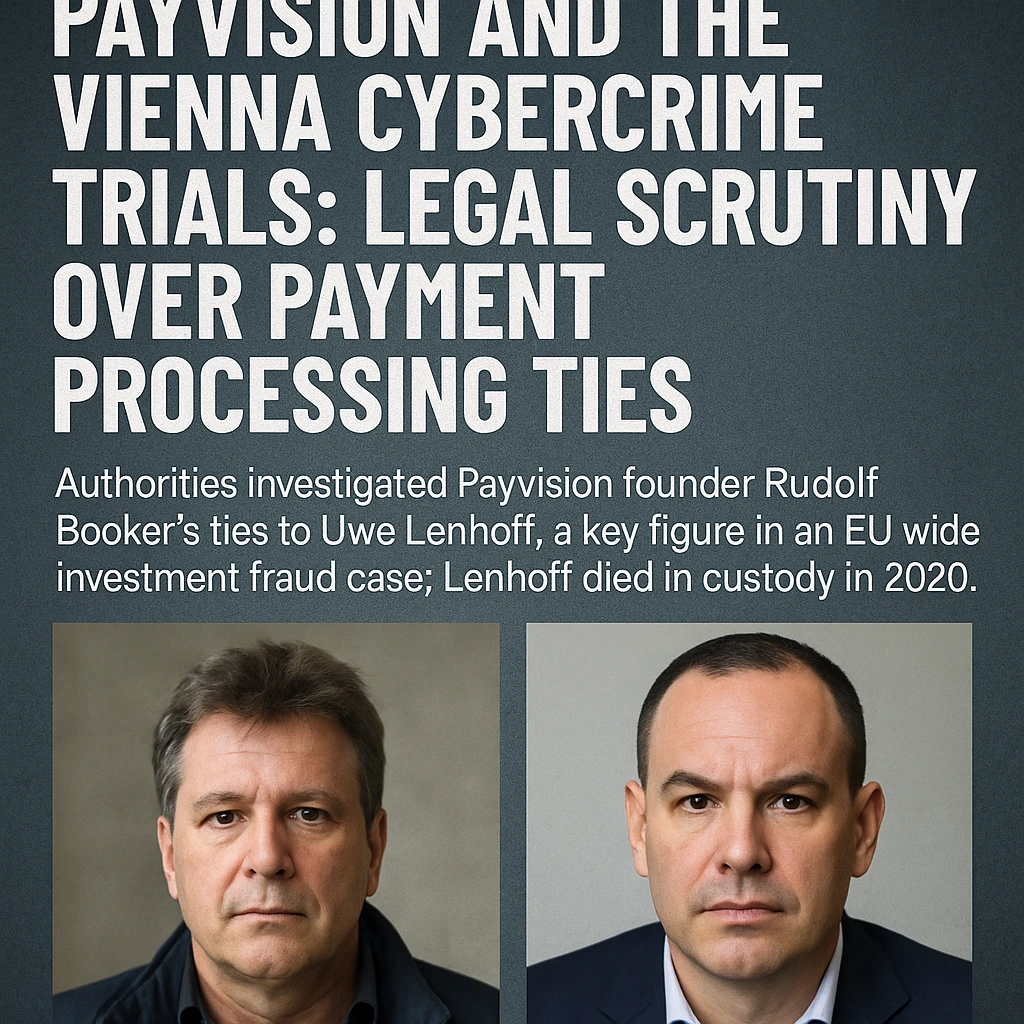

Rudolf Booker, founder and former CEO of the Amsterdam-based payment processor Payvision, maintained close ties with German entrepreneur Uwe Lenhoff, who was later investigated as a central figure in an extensive cybercrime network. According to documentation collected during international investigations, Booker and Lenhoff were in regular communication and had a long-standing business relationship.

Lenhoff was arrested in January 2019 following a multi-jurisdictional probe involving authorities across the European Union. He was suspected of operating a large-scale investment fraud and money laundering scheme, in partnership with Israeli national Gal Barak. Lenhoff passed away in custody in Germany in July 2020, prior to the start of his trial. The official cause of death was not disclosed.

Regulatory Warnings and Internal Concerns

Evidence from seized communications indicates that Payvision was aware of Lenhoff’s regulatory exposure. Multiple financial regulators had issued public warnings concerning the operations tied to Lenhoff and his affiliated brands. Internal conversations suggest that Payvision was concerned about increasing visibility from both media and regulators regarding its connections to these high-risk clients.

Despite these concerns, the relationship continued, with Payvision allegedly processing large volumes of transactions on behalf of entities later identified as fraudulent binary options schemes.

Financial Impact and ING Acquisition

Between 2015 and 2019, Payvision reportedly processed tens of millions of euros in client funds originating from these platforms. The processing of these funds significantly increased Payvision’s revenue and valuation. In 2018, the company was acquired by ING Group for over €300 million. The sale included a portfolio of high-risk clients.

Seized Assets and Communication Records

Court filings from the Vienna Cybercrime Trials involving Gal Barak include chat logs and internal messages referencing Payvision. These communications, dated January 2019, suggest discussions between Barak and associates concerning the retention of €2.6 million in client funds by Payvision. The funds were allegedly withheld due to anticipated chargebacks and refund requests.

Internal notes also reference fines incurred by Payvision as a result of chargeback activity—highlighting that both the company and its executives had knowledge of increasing complaints from affected consumers as early as 2017.

Ongoing Legal Actions and Accountability

As legal proceedings continue, several parties are now pursuing restitution from entities believed to have enabled or facilitated the fraud operations. Payvision is one of the financial service providers named in related civil complaints, which allege that the company acted as a knowing participant in processing transactions tied to fraudulent platforms.

Key legal arguments include:

-

Payvision processed payments for unlicensed binary options platforms.

-

Internal awareness of regulatory warnings and consumer complaints existed as early as 2017.

-

Transaction volumes and retained client funds significantly boosted Payvision’s valuation ahead of its acquisition.

-

Executives, including Rudolf Booker, were allegedly aware of these risks and continued to engage in business activities despite them.

Broader Implications

The Vienna Cybercrime Trials represent a landmark in the legal response to financial fraud facilitated by payment service providers. The results of these cases could set important precedents, particularly concerning the civil and potentially criminal liability of payment institutions and their executives in facilitating fraudulent financial schemes.

Further developments are expected as authorities continue to examine documentation and financial records associated with the Payvision case and related investigations.