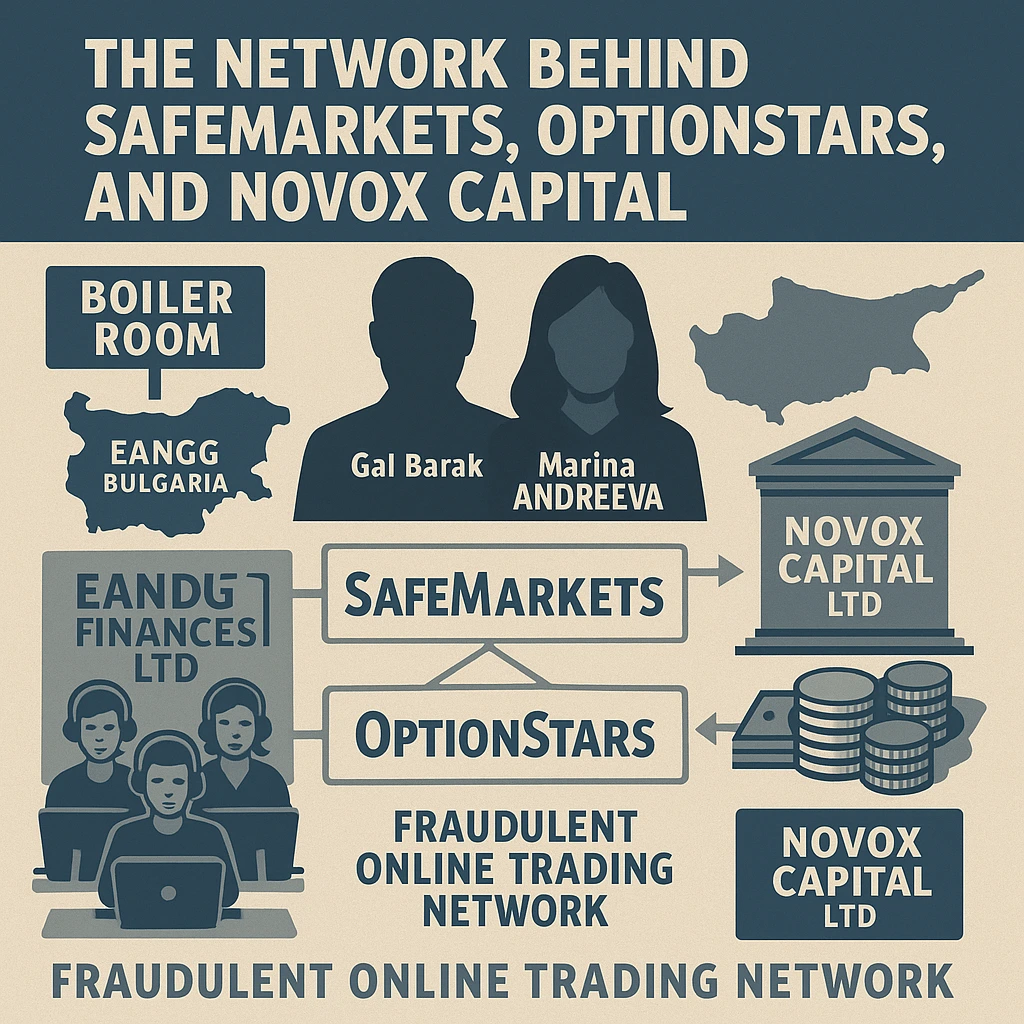

Background: Deconstructing a Fraudulent Ecosystem

With the shutdown of the binary options platform SafeMarkets, attention is shifting toward examining the wider infrastructure behind it. SafeMarkets is believed to have been part of a larger, opaque network that has drawn warnings from financial regulators across multiple jurisdictions.

Key Entities Involved

The primary companies linked to this operation include:

-

EandG Finances Ltd (Bulgaria)

-

Novox Capital Ltd (Cyprus)

EandG Finances Ltd: The Boiler Room Operation

Evidence suggests that the ultimate beneficiaries of SafeMarkets were Gal BARAK and Marina ANDREEVA, individuals previously connected with binary options operations. These figures are allegedly operating behind offshore entities registered in places like Panama, Samoa, and the Marshall Islands. While the ownership structure is still being confirmed, EandG Finances Ltd has been identified as one of the main operational entities.

Based in Sofia, Bulgaria, EandG Finances ran call centers—commonly referred to as boiler rooms—that handled client interactions for multiple platforms. The team reportedly included individuals from Israel, Albania, the USA, and Bulgaria. According to her LinkedIn profile, Marina ANDREEVA was directly involved in EandG’s operations.

The company also supported other platforms such as OptionStars and OptionStarsGlobal, functioning as a service provider for both binary options and forex brands. More background on Marina ANDREEVA and her associates can be found at optionstarsrevealed.com.

Novox Capital Ltd: The Financial Hub

Novox Capital Ltd, based in Cyprus and licensed by CySEC, has played a significant role in facilitating financial operations for various platforms, including SafeMarkets and OptionStars. Regulatory disclosures indicate that Novox was responsible for payment processing and custody accounts. In fact, the domain optionstars.com was registered under Novox’s name in 2014.

CySEC’s regulatory actions against Novox Capital have included fines, but the company’s license has not been revoked—raising concerns over the effectiveness of investor protection mechanisms in Cyprus.

Platforms previously linked to Novox include:

-

OptionStars

-

ZoomTrader

-

ZoomTraderGlobal

-

OptionBit

-

Option888

All of these have been subject to regulatory warnings in the EU, North America, and parts of Asia.

Scale of Financial Harm and Ongoing Investigations

According to a 2016 report by the French AMF, nearly 90% of clients lose money trading binary options, even with regulated firms like Novox Capital. With unregulated entities, the AMF warned of near-total loss. Investigative reports, including coverage by Simona WEINGLASS in The Times of Israel, support these findings.

Sources claim that substantial sums have been frozen in accounts linked to this network, including at major institutions such as Deutsche Bank. Investigations are ongoing.

Upcoming Disclosures

Further reports are expected to cover:

-

The freezing of bank assets connected to the operation

-

The roles of Dream Pay, Vladislav SMIRNOV, and

-

Connections to VELTYCO GROUP PLC